Explore transformative long-term themes

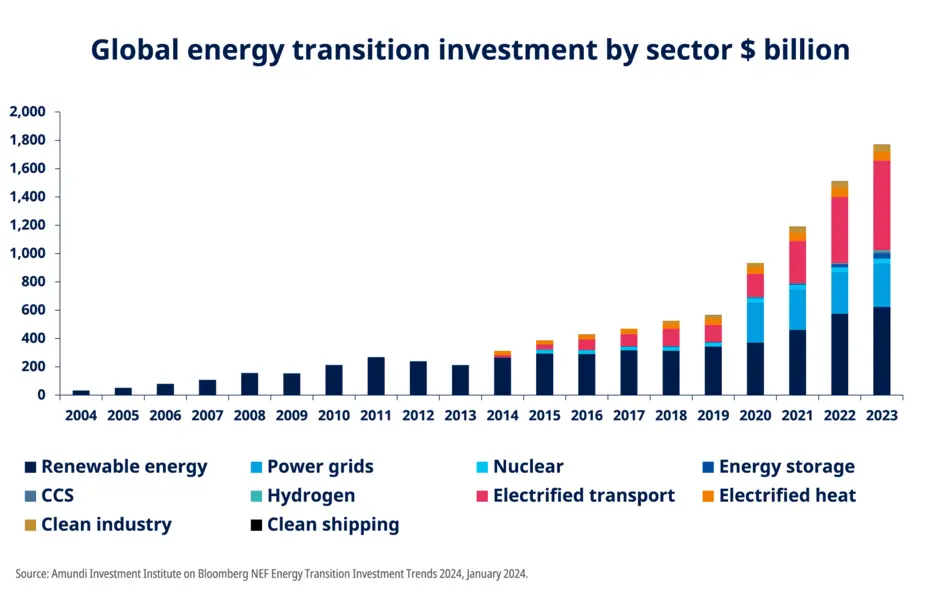

We believe that responsible investing will remain central to the asset management industry. The shift towards clean energy continues, presenting numerous investment opportunities. Therefore, investors should not be sidetracked by temporary challenges and maintain a long-term focus.

Regulatory developments are accelerating and driving change; however, they also add complexity for investors. This evolution is evident in the growing demand for investment solutions with tangible real-world impacts, including transition finance, biodiversity initiatives, and engagement activities.

Several key themes are emerging for responsible investors. The growth of renewable energy is accelerating. We see opportunities in renewable energy operators and suppliers of equipment for wind, solar, and hydro markets. We favour utilities operating in regulated environments that facilitate cost recovery for decommissioning coal plants and transitioning to clean energy. Additionally, equipment suppliers are witnessing robust structural demand growth. This trend is expected to continue, especially with advancements in artificial intelligence. AI technologies, with their significant energy consumption, are expected to drive increased demand for data center equipment.

Among commodities, copper’s demand is projected to double by 2035. Its excellent conductivity makes it the preferred mineral for electricity networks connecting homes and businesses to renewable sources. It is also crucial in manufacturing solar panels, wind turbines, and electric vehicle batteries. A strong copper price is anticipated in the medium term, benefiting mining companies. Additionally, the growth in electric vehicle sales is driving robust demand for batteries, with regional variations. China remains the primary driver of this market, with expectations for further acceleration in 2025.

Investors must remain adaptable to navigate this evolving landscape. The relationship between the transition and physical climate risks is complex. Rising temperatures increase physical risks, while delays in implementing transition policies could reduce the prospects of an orderly transition and increase transition risks. Notably, the economic impact of rising temperatures may surpass that of carbon pricing or policy changes.

* Diversification does not guarantee a profit or protect against a loss.

Unless otherwise stated, all information contained in this document is from Amundi Asset Management S.A.S. and is as of 12 February 2025. Diversification does not guarantee a profit or protect against a loss. The views expressed regarding market and economic trends are those of the author and not necessarily Amundi Asset Management S.A.S. and are subject to change at any time based on market and other conditions, and there can be no assurance that countries, markets or sectors will perform as expected. These views should not be relied upon as investment advice, a security recommendation, or as an indication of trading for any Amundi product. This material does not constitute an offer or solicitation to buy or sell any security, fund units or services. Investment involves risks, including market, political, liquidity and currency risks. Past performance is not a guarantee or indicative of future results.

Date of first use: 12 February 2025

Doc ID: 4231005

Marketing Communication - For Professional Clients Only