Diversify* across different axes

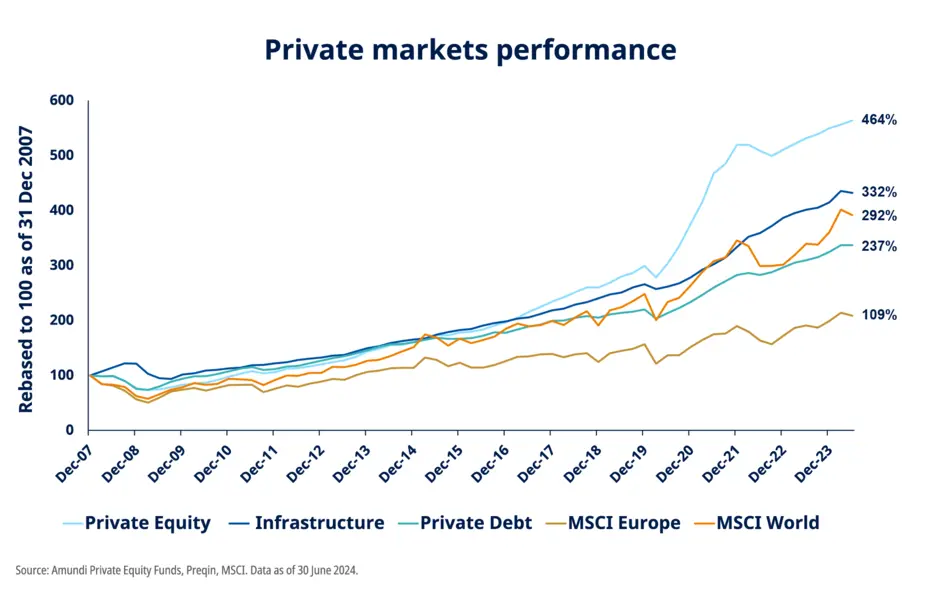

Private markets and hedge funds offer significant diversification* potential and investment opportunities due to easing monetary policies.

In private equity, transaction volumes are gradually increasing, and pricing has stabilised. Trading activities are concentrated in high-quality, non-cyclical sectors, which benefit from robust structural growth, pricing power, and strong cash flow generation. Concurrently, high valuation multiples in the public market ensure that the relative valuation levels in the private market are more attractive, offering better entry points compared to a year ago.

Regarding private debt, companies continue to leverage strong bargaining power in negotiating lending contracts, partly due to the persistent constraints on bank financing, although this trend is diminishing.

We favour infrastructure investment due to its promising growth outlook and consistent cash flow. Although transaction volumes are lower than in previous years, the market remains active. Lower interest rate expectations are bolstering activity, while the energy transition is expected to drive growth in the coming years.

In real estate, the outlook for 2025 appears more positive than the previous year. Investment turnover in European commercial real estate remains low. However, it has shown year-on-year growth in the first half of 2024, aided by recent repricing. In the leasing sector, rents are expected to benefit from the relatively limited supply of highly sought-after assets; however, the rental outlook for non-prime offices remains weak.

Hedge funds remain an attractive source of diversification*. The current scenario, defined by a highly polarised mix of positive factors, alongside anomalies and tail risks, indicates a cycle phase marked by a series of shocks, resulting in brief economic phases and some traits of an early cycle. Alpha is likely to remain abundant in Long/Short Equity, while Merger Arbitrage is expected to unlock greater potential under the new Trump administration. Long/Short Credit continues to provide an attractive gateway at manageable risk. The backdrop is also becoming more favourable for Global Macro, while we maintain a neutral stance on CTAs.

* Diversification does not guarantee a profit or protect against a loss.

Unless otherwise stated, all information contained in this document is from Amundi Asset Management S.A.S. and is as of 12 February 2025. Diversification does not guarantee a profit or protect against a loss. The views expressed regarding market and economic trends are those of the author and not necessarily Amundi Asset Management S.A.S. and are subject to change at any time based on market and other conditions, and there can be no assurance that countries, markets or sectors will perform as expected. These views should not be relied upon as investment advice, a security recommendation, or as an indication of trading for any Amundi product. This material does not constitute an offer or solicitation to buy or sell any security, fund units or services. Investment involves risks, including market, political, liquidity and currency risks. Past performance is not a guarantee or indicative of future results.

Date of first use: 12 February 2025

Doc ID: 4231005

Marketing Communication - For Professional Clients Only