Key takeaways

- The ELTIF 2.0 framework is opening new opportunities to access private markets.

- Evergreen funds offer a variety of benefits to investors, especially those with limited capital to invest.

- Evergreen funds need to adopt various liquidity management strategies to develop a fund liquidity profile that matches the inherent illiquidity of their underlying assets.

- Investors should rely on an asset manager with a rigorous risk management process and proven knowledge and expertise to build robust and diversified portfolios.

The ELTIF 2.0 regime opens a new window of opportunity for investors

Until recently, private markets have been the domain of institutional investors, due to their illiquid nature and the requirement of large minimum investment tickets. However, retail clients are showing a growing interest in alternative investments due to a pressing need to diversify their portfolios in terms of allocation and time horizon, while also seeking higher returns. We are now witnessing a trend towards the “democratization” of private markets, supported by the second version of the European Long-Term Investment Fund (ELTIF) Regulation.

The revised ELTIF 2.0 regime1, which entered into effect in January 2024, introduced enhanced flexibility in establishing and managing ELTIFs, notably by abolishing the minimum ticket size and allowing indirect investments through funds. This shift not only broadened the investable universe in private markets but also made them more accessible to individual investors.

In addition, ELTIF 2.0 is enabling the launch of evergreen funds, thereby increasing their accessibility to private clients. Evergreen funds are open-ended investment products with a perpetual lifespan, allowing investors to subscribe and redeem their capital periodically throughout the life of the fund, under pre-determined conditions.

These products are particularly suited for investors seeking greater liquidity and flexibility, despite the fact that the underlying assets in the portfolio remain largely illiquid. It is important to recognize that an evergreen fund, from an operational standpoint, requires careful structuring, creating additional complexity for the investment manager. A robust liquidity management framework throughout the setup phase and the life of the fund is crucial for risk mitigation. This should be combined with a solid due diligence process and continuous monitoring of the underlying assets to deliver value to clients.

Why should investors turn to evergreen formats?

Evergreen funds present a range of advantages that make them an appealing choice for investors, in particular those who may have limited capital to commit.

One of the primary benefits is their accessibility to clients, facilitating the availability of such products for retail distribution.

Traditionally, private market funds are closed-ended with a designated investment period. Investors commit to subscribing a certain amount at the start, and their capital can only be called upon periodically throughout the fund’s life, depending on how long it takes for new investment opportunities to arise. Clients typically experience the "J-curve”3 effect, where net cash flow is initially negative in the early years before it can turn positive.

- The fund calls capital over the first 4 years and makes distributions in the second half of its 8/10-year term.

- Net cash flow is initially negative.

- Investments gradually mature and realize value later in the fund’s lifecycle.

- Continuous capital subscription and redemption.

- No J-curve; no capital calls nor distributions.

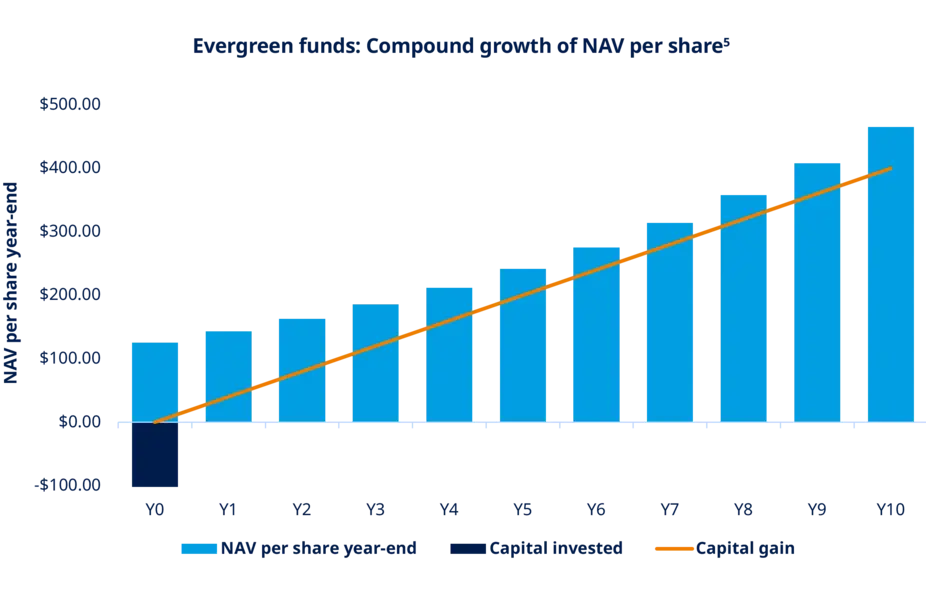

- After an evergreen fund is launched and running, new subscriptions will be exposed to an existing and well-performing portfolio, and continuously re-invested for continuous NAV growth.

The impact of the J-curve is not seen in evergreen funds, where capital is deployed almost immediately. These funds are open-ended and designed to operate indefinitely, allowing for continuous investment and redemption. This continuous capital deployment helps maintain a more stable return profile and reduces the initial negative returns typically seen in the J-curve. This flexibility is crucial, as it allows investors to adjust their exposure based on market conditions or personal financial needs. In contrast to traditional closed-end funds, where capital is typically locked up for 8-12 years. In essence, evergreen strategies allow for a more “patient” and tailored investment approach.

Since they have no fixed lifespan, these funds can retain ownership in companies and other valuable assets for extended periods based on their investment strategy and for as long as they deem fit. They can avoid selling them at inopportune moments due to constraints related to the fund’s lifespan. Additionally, as older investments mature and are sold, the proceeds are reinvested into new opportunities, ensuring that the portfolio remains dynamic.

Navigating liquidity in illiquid markets

Evergreen funds must implement a series of liquidity management strategies to create a fund liquidity profile that aligns with the intrinsic illiquidity of their underlying assets.

One of the primary mechanisms is the establishment of a minimum ramp-up period, which corresponds to the time during which the fund makes its initial investments. Under ELTIF 2.0, redemptions are not permitted during the fund’s initial ramp-up phase, providing the fund manager with the necessary time to effectively develop and diversify the portfolio. This approach ensures that the fund can build a robust investment base before allowing investors to withdraw their capital.

To facilitate a smoother redemption process, evergreen funds usually implement adequate notice periods. Investors must notify the asset manager of their redemption requests within a specified timeframe. This advance notice allows the fund to proactively manage liquidity and plan for potential cash outflows, ensuring that the portfolio remains stable.

Another critical feature is the gating mechanism, which restricts the total percentage of the overall portfolio that can be redeemed on each redemption date. Typically, this limit under the gating mechanism is set at around 5% of fund assets per quarter. In situations where redemption requests exceed the threshold, they will often be fulfilled on a pro rata basis.

Finally, evergreen funds usually invest a minimum portion of their assets into liquid instruments that are eligible under UCITS regulations, ensuring that a minimum level of liquidity is always available.

| ELTIF 2.0 in brief | |

|---|---|

| What does it mean? | European Long-Term Investment Funds (ELTIF). |

| Why do we talk about 2.0? | ELTIF 2.0, applicable since January 2024, is the review of Regulation (EU) 2015/760 (ELTIF Regulation) concluded in February 2023 by the European Commission. |

| Why and for whom? | The aim was to enhance the attractiveness of European Long-Term Investment Funds (ELTIFs). By definition, these are regulated investment funds that seek to invest capital in long-term projects. They are accessible to both professional and retail investors. This regulation focuses on and promotes investments in European markets, although similar long-term investment structures exist globally. |

| Why does it make sense? | These projects include, among other things, infrastructure, real estate, sustainable energy, and small to medium-sized enterprises (SMEs) that are not listed on a stock exchange. The objective of ELTIFs is to promote long-term capital inflows into the European economy in order to support economic growth and employment. Another important objective of ELTIF 2.0 is to support the European Green Deal initiative and the transition to a low-carbon economy. By providing targeted support for investments in sustainable projects, ELTIFs help to achieve the European Union's climate targets and promote sustainable growth. |

Why partner with Amundi Alternative & Real Assets (ARA)?

With the rise of evergreen funds in private markets, investors must select an asset manager that can ensure and control the deployment of capital in a timely and profitable manner.

Amundi ARA, a trusted European partner with over 40 years of experience, manages 11 evergreen funds, demonstrating its expertise in structuring and managing long-term investments.

Amundi ARA is a leading player in private markets asset management, with €71 billion AuM in real and alternative assets, supported by 330 professionals, and 8 investment hubs located in Paris, London, Milan, Luxembourg, Barcelona, Madrid, Dublin and Zurich.6

Amundi ARA combines a rigorous risk management process with proven expertise to build robust and diversified portfolios across all segments of private markets, including: private equity, infrastructure, private debt, real estate and multi-selection of General Partners (GPs) across these asset classes. The strategies employed may include pure asset class strategies or a combination of them. Amundi ARA is able to create tailored vehicles, such as ELTIFs 2.0 evergreen funds, through direct investments or funds-of-funds.

Amundi ARA’s management team is dedicated to creating strong value for all stakeholders. Believing that companies and financial actors have a responsibility to address the major challenges of our time, the company actively facilitates the evolution of society towards a more sustainable development model. All of Amundi ARA’s current evergreen funds incorporate environmental, social, and governance (ESG) factors into their investment processes and asset selection throughout the entire holding period, in addition to reporting in accordance with the Sustainable Finance Disclosures Regulation (SFDR)7.

As an investor of the real economy, Amundi ARA leverages its expertise on behalf of both retail and institutional investors to develop optimal and innovative solutions.

Discover our evergreen fund

Amundi Private Markets ELTIF

1 The objective of the ELTIF 2.0 regulation is to promote long-term European investment in the real economy, encouraging a sustainable and inclusive growth. Please refer to the “ELTIF 2.0 in brief” section for further information.

2 Source: Goldman Sachs Asset Management, from US Securities and Exchange Commission, European Securities and Markets Authority – Commission de Surveillance du Secteur Financier (CSSF).

3 A J-curve depicts a trend that starts with a sharp drop and is followed by a dramatic rise. In private equity, the J-curve is common: private equity funds commonly enter a period of negative return in their initial years. This can be dependent on different factors but it typically is down to management costs, investment costs and operational fees as well as a portfolio that hasn’t yet matured. Once matured, however, the returns can rise well beyond their starting point — forming the J-curve.

4 For illustrative purposes only. Conversion in cash and repayment happens upon liquidation of the fund at end of life.

5 Conversion in cash and repayment happens upon submission of the redemption in accordance with pre-determined redemption provisions.

6 Source: Amundi ARA, as of end of December 2024.

7 Please refer to the Amundi Global Responsible Investment Policy and the Amundi Sustainable Finance Disclosure Statement available at https://www.amundi.com/globaldistributor/responsible-investment-policies-reports.

Unless otherwise stated, all information contained in this document is from Amundi Asset Management S.A.S. and is as of 12 February 2025. Diversification does not guarantee a profit or protect against a loss. The views expressed regarding market and economic trends are those of the author and not necessarily Amundi Asset Management S.A.S. and are subject to change at any time based on market and other conditions, and there can be no assurance that countries, markets or sectors will perform as expected. These views should not be relied upon as investment advice, a security recommendation, or as an indication of trading for any Amundi product. This material does not constitute an offer or solicitation to buy or sell any security, fund units or services. Investment involves risks, including market, political, liquidity and currency risks. Past performance is not a guarantee or indicative of future results.

Date of first use: 12 February 2025

Doc ID: 4192435

Marketing Communication – For Professional Clients only