Embrace the power of Asia and EM’s comeback

Despite being a key engine of global growth, we believe there are still misconceptions about emerging markets, leading to their underrepresentation in investors’ portfolios.

Watch the video to learn more.

Emerging markets present a dynamic investment landscape with both opportunities and challenges, especially given uncertainties around the new U.S. administration's policies.

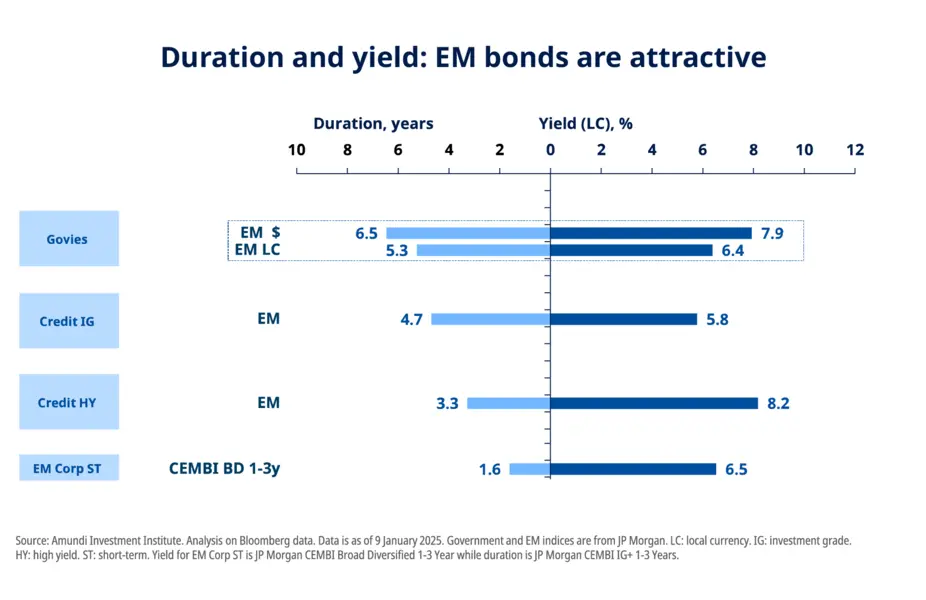

In fixed income, we prefer emerging market hard currency debt but remain selective. We favour local rates in countries with high nominal and real yields, less exposed to potential U.S. policy impacts, including tariffs. We also seek selective opportunities in high yield credit, anticipating no significant spread widening as new issuances should be well absorbed.

In equities, we maintain a neutral stance due to high geopolitical risks. However, we acknowledge that current valuations in emerging market equities are attractive and may offer favourable entry points soon.

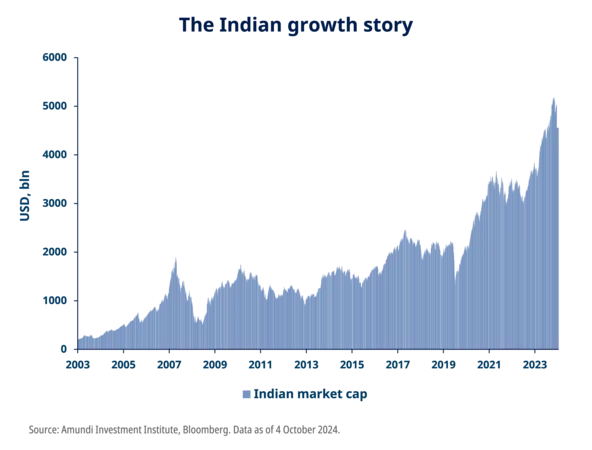

We view India as a long-term growth story and remain cautiously optimistic about China, given its appealing valuations and expected policy support.

As 2025 begins, India stands at a crucial point in its economic journey. After robust performances in recent years, the economy shows signs of a moderate slowdown. In our view, it is essential to look beyond short-term narratives and focus on long-term structural trends.

India’s GDP growth is expected to stabilise between 6% and 7% in 2025. This highlights the country’s significant role in global economic growth.

Inflation is projected to stay within the Reserve Bank of India (RBI)’s target range. However, the RBI’s ability to adjust monetary policy seems limited, as it seeks to maintain a neutral positive rate environment.

In this changing landscape, India is strengthening its infrastructure and leveraging its strengths to enhance its position in global value chains. This positions India as a key driver of long-term growth, ready to navigate the complexities of the global economy in the coming years.

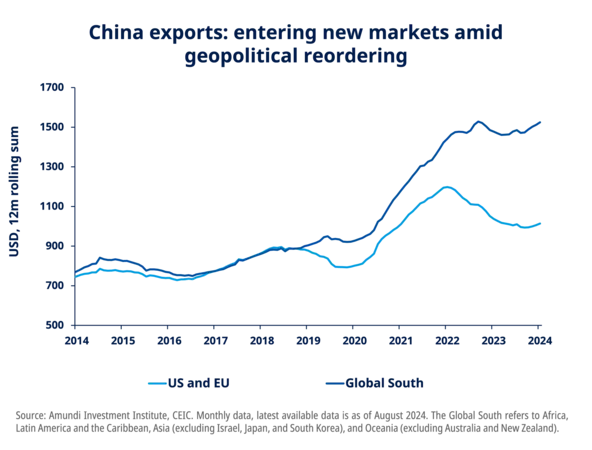

In recent months, China's leadership has adopted unconventional economic policies, including monetary easing and expansionary fiscal measures. However, these efforts may not fully address the structural challenges and impacts of US tariffs.

China's economic growth is projected to decline from 5.0% in 2024 to 4.1% in 2025, and further to 3.6% in 2026. If aggressive US trade protectionism continues, China may need to maintain its expansionary fiscal stance longer than expected.

Chinese equities will be influenced by the Trump administration's foreign policy, while additional stimulus could support Chinese markets, particularly domestic stocks. We maintain a neutral stance in the short term, favouring domestic markets.

Thanks to a robust cross-asset EM platform, we can provide investors with one of the most comprehensive offerings in the market. What does our EM investment team focus on? How do we differentiate?

We believe EMD stands out as an attractive investment opportunity being in a macroeconomic sweet spot. How does it offer a compelling case for investors in today's fragmented global landscape?

The asset class has traditionally been perceived as a tactical investment opportunity or as an off-benchmark allocation. Why do we believe EMD should now serve as a core allocation in investors’ portfolios?

* Diversification does not guarantee a profit or protect against a loss.

Unless otherwise stated, all information contained in this document is from Amundi Asset Management S.A.S. and is as of 12 February 2025. Diversification does not guarantee a profit or protect against a loss. The views expressed regarding market and economic trends are those of the author and not necessarily Amundi Asset Management S.A.S. and are subject to change at any time based on market and other conditions, and there can be no assurance that countries, markets or sectors will perform as expected. These views should not be relied upon as investment advice, a security recommendation, or as an indication of trading for any Amundi product. This material does not constitute an offer or solicitation to buy or sell any security, fund units or services. Investment involves risks, including market, political, liquidity and currency risks. Past performance is not a guarantee or indicative of future results.

Date of first use: 12 February 2025

Doc ID: 4231005

Marketing Communication - For Professional Clients Only