Broaden the opportunity set in equities and look at sectors

In the current equity landscape, there is an overall positive sentiment. The emphasis is on diversification* to capitalise on a broadening market rally beyond mega caps.

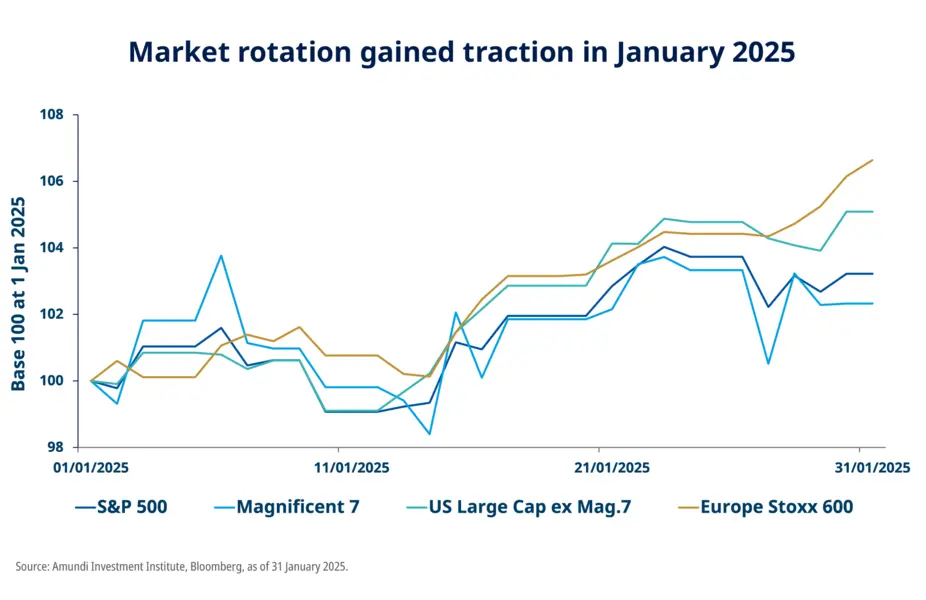

This perspective is particularly relevant in light of market uncertainties. These are linked to geopolitical and macro factors, as well as unforeseen events, like the DeepSeek announcement in late January 20251.

Investors are encouraged to adopt a selective approach. In our view, they should expand the investment universe, shifting away from areas characterised by high valuation levels. Instead, they should focus on sectors and companies poised to benefit from favourable policies while maintaining reasonable valuations.

In the United States, the “Magnificent 7” led earnings growth in the first half of 2024. However, the latter half of the year saw a broader market rally. We anticipate this trend will persist into 2025. We see opportunities in financials and materials. Winners should include banks, able to benefit from current rate levels and lower expected taxes. Caution is advised regarding the technology and consumer sectors due to potential vulnerabilities.

The broadening market rally might support European equities. Valuations in Europe appear attractive compared to the United States. Markets will focus on earnings direction and the potential impact of Trump’s policies. Consumer staples and healthcare should benefit from the forecasted rate cuts and slowing inflation. In the financial sector, the focus is on quality European banks with strong fundamentals. Opportunities are being explored in luxury goods. We remain cautious in technology and industrials. European small- and mid-cap stocks could represent a valuable tool for enhancing portfolio diversification.* They show compelling fundamentals and are particularly sensitive to positive changes in economic conditions and reduced interest rates. A strong focus on stock selection is essential.

In conclusion, 2025 presents a constructive environment for equities investors. Nevertheless, selectivity will be crucial for capturing opportunities across regions and sectors.

* Diversification does not guarantee a profit or protect against a loss.

1 US AI-related semiconductor stocks registered a strong decline on Monday, January 27th, following the launch of an AI assistant by the Chinese firm DeepSeek.

Unless otherwise stated, all information contained in this document is from Amundi Asset Management S.A.S. and is as of 12 February 2025. Diversification does not guarantee a profit or protect against a loss. The views expressed regarding market and economic trends are those of the author and not necessarily Amundi Asset Management S.A.S. and are subject to change at any time based on market and other conditions, and there can be no assurance that countries, markets or sectors will perform as expected. These views should not be relied upon as investment advice, a security recommendation, or as an indication of trading for any Amundi product. This material does not constitute an offer or solicitation to buy or sell any security, fund units or services. Investment involves risks, including market, political, liquidity and currency risks. Past performance is not a guarantee or indicative of future results.

Date of first use: 12 February 2025

Doc ID: 4231005

Marketing Communication - For Professional Clients Only