As Europe navigates the complexities of pursuing strategic autonomy, the financial landscape is witnessing a significant shift. The first quarter of 2025 has marked a notable reversal of long-standing market trends, with European assets gaining renewed interest amid uncertainties surrounding the US economy.

Against this backdrop, improving economic conditions over the medium term and a robust investment-grade credit outlook suggest that the stage is set for a compelling narrative in European equities and bonds.

The convergence of US and European government bonds

In the near term, a dovish European Central Bank (ECB) should be supportive of fixed income assets. However, the bigger medium-term question is whether the region’s government bond yields, which have been significantly lower than their US counterparts since 2012, will go back to their prior relationship that saw these two assets maintain comparable yields. Stronger European growth should see the current yield gap diminish, with European yields moving higher.

In addition, supply could provide a catalyst for the yield curve to steepen. While net issuance is expected to remain at the same level as 2024, at around EUR 430 billion, the ECB’s balance sheet shift from quantitative easing (QE) to quantitative tightening (QT) has seen it become a seller of fixed income rather than a purchaser. QT redemptions for 2025 are forecast to rise to EUR 380 billion.

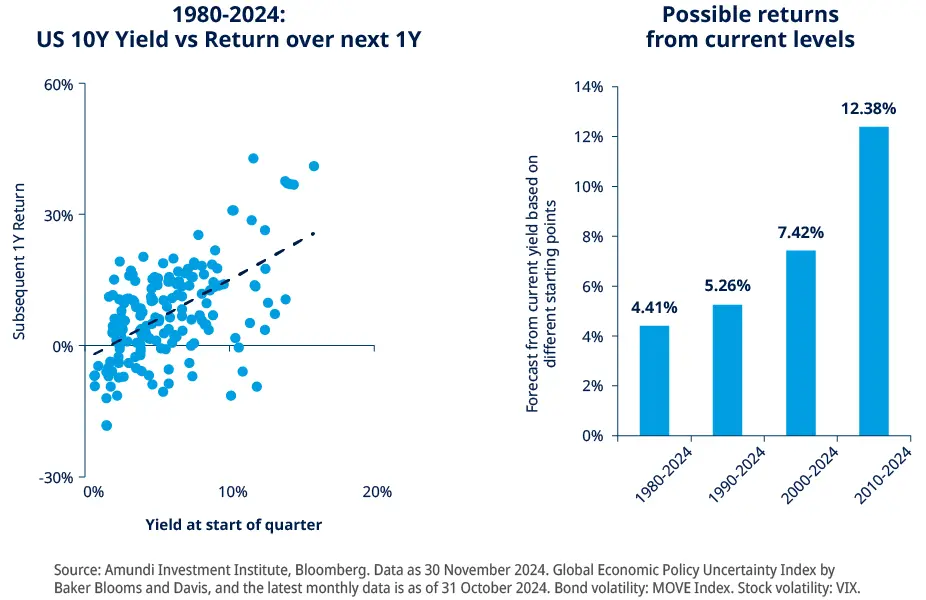

Although the expectation for government bonds is for yields to move higher in the near term, we are optimistic for the asset class overall. Firstly, higher yields tend to correlate to higher returns over the fullness of time. A return to a low growth / low inflation environment – similar to the 2010-2014 period – could mean the future for fixed income investors is favourable.

The outlook for European investment grade credit is even more promising, supported by the improving economic backdrop, strong internal demand and robust issuance. European issuers also exhibit much better balance sheet quality and less financial leverage than their US counterparts. The financial sector should extend its positive performance, benefitting from lower interest rates, while industrials and technology credit should be able to take advantage of the greater fiscal spending.

Equities to benefit from Europe’s renewed strategic autonomy

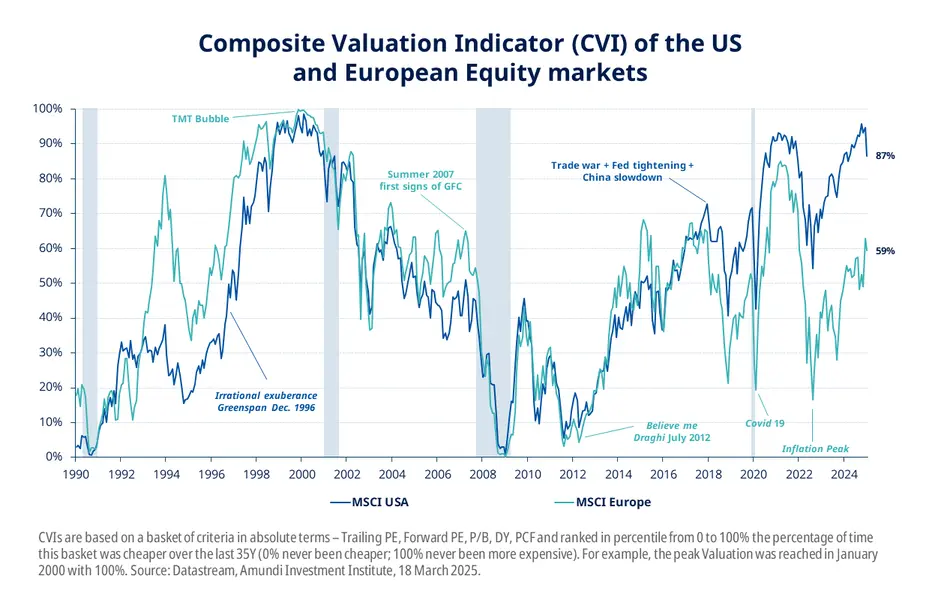

European equities are benefiting from the rotation away from the Magnificent 7 stocks that have dominated over the last two years. As investors look for alternative opportunities, they have been attracted by the much lower valuations of European stocks, where underperformance has seen this market become one of the cheapest in the world.

The appetite for European stock has been further reinforced by the unexpected German budgetary expansion, as well as hopes for a ceasefire and subsequent reconstruction in Ukraine. This year, the trend for European stocks versus the S&P 500 has been of the same magnitude as during the aftermath of the Great Financial Crisis.

Naturally, investors are questioning whether this rotation will be sustained. However, we believe several fundamental changes have occurred this year that will continue to support European equities as Europe seeks to reestablish its strategy autonomy.

First, it’s important to keep in mind that Europe is a strong economic power. It has a vast population of well-educated people and a strong industrial base.

Secondly, the Trump administration has clearly signalled that it is no longer willing to prop up Europe’s defence network. Since the end of the Cold War, Europe has enjoyed a significant peace dividend and underspent on defence. The new US stance has forced Europe to recognise that it can no longer afford to do so, and the wider European Union – alongside Germany – has committed not only to catch up on defence spending, but also invest in infrastructure, technology, energy autonomy, and banking and capital market integration.

In addition, while there are still many challenges to overcome, notably the fragmentation of Europe, the urgency to implement real change has finally been acknowledged. This is no longer considered a choice but a necessity.

Alongside Europe’s newfound political will, investors also need fundamental arguments. European earnings have long lagged those of other developed nations, not just the US but Japan too. The region’s higher growth potential in the coming years should boost earnings, as fiscal investment in defence and infrastructure flows through to companies’ balance sheets. The valuation side of the equation is far more flattering for European stocks, which remain far cheaper than their still expensive US counterparts.

From a sector perspective, the threat of looming US tariffs means that domestically-focused industries and services are favoured over exporters. Therefore, financials and telecoms are favoured over energy providers and consumer discretionary product manufacturers.

In addition, sectors that relate to Europe’s new strategy autonomy agenda should be well-positioned to take advantage of the spending plans being put in place. Aside from the expansion of the region’s military capabilities, fiscal expenditure will also target manufacturing, finance, food production, healthcare and cyber security.

A constructive outlook

While the path ahead for European assets may be fraught with volatility, the underlying fundamentals present a constructive outlook. The region's structural shift towards strategic autonomy is set to fuel growth in the coming years, creating a wealth of compelling investment opportunities.

Although the trajectory for European equities and bonds may not be smooth, the commitment to enhancing economic resilience and addressing long-standing challenges positions Europe favourably.

As investors navigate this pivotal moment, they are encouraged to look beyond short-term fluctuations and embrace the potential for growth in both asset classes. It is indeed time for Europe to reclaim its position on the global investment stage.

|

| Amundi Funds European Equity Income ESG |

| Amundi Funds European Equity | |

|

| Amundi Funds European Equity Small Cap |

| CPR – European Strategic Autonomy | |

|

| Amundi Stoxx Europe 600 UCITS ETF |

|

| Amundi Funds Euro Corporate ESG Bond |

| Amundi S.F. Diversified Short-term Bond ESG | |

|

| Amundi Funds European Subordinated Bond ESG |

| Amundi EUR Corporate Bond UCITS ETF |

|

| Amundi Funds Euro Multi-Asset Target Income |

Read our article on tapping into Europe’s future growth

Unless otherwise stated, all information contained in this document is from Amundi Asset Management S.A.S. and is as of 1 April 2025. Diversification does not guarantee a profit or protect against a loss. The views expressed regarding market and economic trends are those of the author and not necessarily Amundi Asset Management S.A.S. and are subject to change at any time based on market and other conditions, and there can be no assurance that countries, markets or sectors will perform as expected. These views should not be relied upon as investment advice, a security recommendation, or as an indication of trading for any Amundi product. This material does not constitute an offer or solicitation to buy or sell any security, fund units or services. Investment involves risks, including market, political, liquidity and currency risks. Past performance is not a guarantee or indicative of future results.

Date of first use: 4 April 2025

Doc ID: 4369084