Key takeaways

- Long-term investors can benefit from the shift to clean sources of energy, which presents significant opportunities driven by decarbonization, energy security, and the cost competitiveness of renewables.

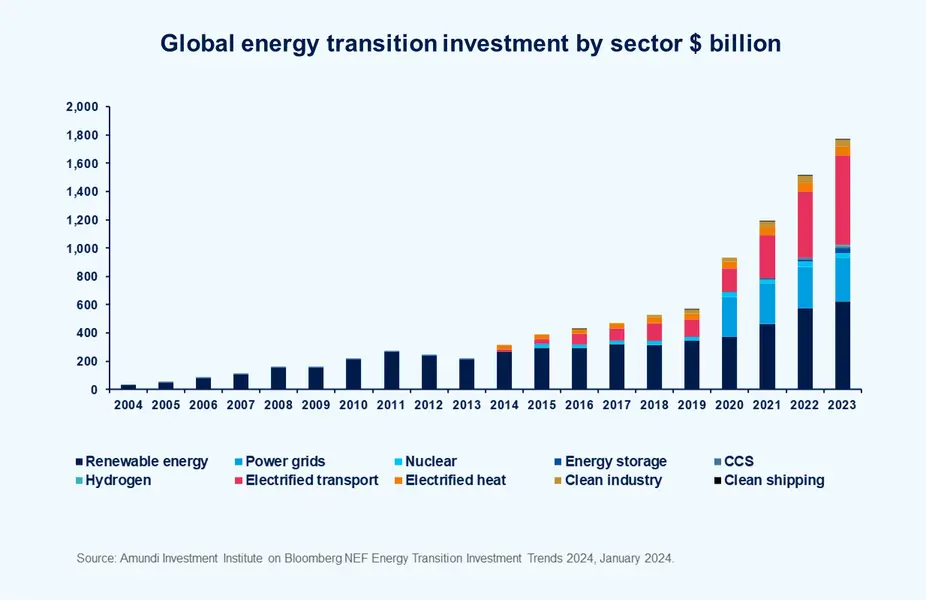

- Although the energy transition has faced some challenges recently, the overall investment outlook remains positive.

- The transition is gradual but ongoing, with potential in companies that enhance renewable energy supply, reduce energy demand, and develop infrastructure.

- As active portfolio managers, our goal is to seize attractive opportunities in companies that are at the forefront of the transition, showing strong earnings growth, favourable valuations and clear competitive moats.

Long-term investors can take advantage of exceptional opportunities in a world transitioning to clean energy. They have the potential to generate alpha, with many secular opportunities, driven by long-term tailwinds of decarbonisation, energy security and the increasing cost competitiveness of renewable energy.

The energy transition theme has been out of favour for some time due to a perfect storm of input cost inflation, rising interest rates and spiking bond yields. Additionally, solar equipment inventory build-ups in Europe and political uncertainty in the US have contributed to project delays.

Despite recent challenges, the investment thesis remains intact. Energy transition is a long-term transformation and, in our opinion, one of the greatest commercial opportunities of our time. Therefore, we shouldn’t equate short-term volatility with fundamental risk.

The transition is happening slowly but steadily. In September 2024, we saw the UK close its final coal-powered electricity generation plant, and we have seen days when solar power generation in Texas exceeds that from fossil fuel generation. Indeed, the overall American grid dropped from being 56% coal-powered in 1985 to about 16% in 2023.1

Therefore, the transition rolls on, and we see potential in companies that provide solutions to:

- help increase renewable energy supply

- decrease energy demand

- build out the infrastructure required to support the energy transition.

The energy transition touches on many aspects of the global economy, from industries involved in renewable energy utilities and building insulation, to key semiconductor manufacturers, battery suppliers, and electric vehicle producers. These industries are driving the shift towards a more sustainable and energy-efficient future. Certain businesses within these industries present compelling investment opportunities, characterized by clear competitive moats and attractive valuation profiles.

The headwinds of recent years are lifting, and we are optimistic about strong catalysts we see on the horizon.

So, despite the dislocation in recent years, we think there is strong evidence that energy transition strategies can capitalise on the strong structural tailwinds supporting the theme to generate alpha in the future. Some companies in this sector are delivering solid earnings growth, but trading at attractive valuations with appealing opportunities for portfolio managers to extract alpha through active management.

Catalysts for re-assessing sentiment for the energy transition sector

We’re particularly focused on four catalysts we see driving improving sentiment in the energy transition theme:

As countries try to meet their Net Zero targets, renewables are key. As the COP28 slogan goes “triple renewables, double down on energy efficiency by 2030”2.

Given their role in decarbonisation, and as solar and wind are cheaper than fossil fuels in most countries, we believe renewables are on track to become the largest source of electricity production by 2025.

The International Energy Agency (IEA) forecasts renewables will account for almost half of global electricity generation by 2030, with the share of wind and solar PV doubling to 30%3. This is a structural shift supported by renewable energy generators and equipment manufacturers.

Beyond financial targets, the recent COP29 in Baku built on previous progress in setting emissions reduction targets, accelerating the energy transition, and reaching a long-awaited agreement on carbon markets. These accomplishments were achieved despite an “uncertain and divided geopolitical landscape” that posed significant challenges to negotiations4.

Surprising as it may seem, from 2010 to 2020, demand for electricity was reasonably flat. Even though the global economy was growing, energy efficiency developments, such as increasing use of LED lighting, meant overall electricity demand was stable.

Developments in recent years, including the advent of AI, cloud computing/more data centres, EV charging and the proliferation of heat pumps, will result in increasing global demand for electricity globally until 2040.

Growing electricity demand requires additional backup generation. Electrification of heating and transport, data centres and an AI-driven future will create growth in power demand not seen in the past two decades. Electricity demand is experiencing three times faster growth per year this decade in comparison to the last, and demand is projected to grow from just over 4000 TWh to almost 5000 TWh by 20405.

Data centres are effectively warehouses full of computer servers central to online business operations. They need a large and constant supply of electricity to operate and cool the servers.

Ireland is a microcosm of what is happening globally as it is home to the headquarters of numerous multinational corporations In 2022, 17% of all electricity generated in Ireland was consumed by data centres owned by companies such as Google, Meta, and Microsoft. This represents a 400% rise in data centre electricity usage since 2015. The IEA expects the proportion of electricity in Ireland used by data centres to rise to 32% by 20266.

The corporates operating these data centres tend to strongly prefer securing their power from renewable sources for corporate and social responsibility reasons, such as meeting carbon reduction targets.

We believe that generalist investors and the wider market have not fully understood the extent of the opportunities available to companies exposed across the value chain of meeting increasing electricity demand.

Globally, investment in energy grids needs to double to more than $600bn a year by 2030 to hit national climate targets after “over a decade of stagnation at the global level”, the IEA said7.

That will mean adding or refurbishing a total of over 80 million kilometres of grids by 2040, the equivalent of the entire existing global grid.

Utility companies to look out for include those that have exposure to critical spending on grid buildout, modernization, and repair.

Multiple compelling factors suggest valuations are currently attractive, including the following four factors that we believe should drive the re-rating of energy transition stocks:

I. Headwinds abating for interest rates

In the past two years, bond yields have risen from nearly 0% to over 5% at one point, marking an unprecedented short-term spike. Uncertainty over the future direction of interest rates on the back of inflation, geopolitics and economic growth considerations has created near-term yield volatility. In turn, that has harmed sentiment towards utilities and interest-rate sensitive stocks.

With softer inflation data as of late, we expect interest rates to continue to fall and, crucially, bond yields not to rise any further. Some utilities are trading at low valuations and should prove attractive, particularly due to their defensive business models, predictable cashflows, and earnings growth potential as they advance renewable generation.

Other sectors should perform better in a stabilising bond yield environment. For example, the US residential solar sector benefits from lower borrowing costs for the installation of home solar panels, as do electric vehicle (EV) car sales.

II. Headwinds abating for wind and solar

Sentiment for the renewables sector in the second half of 2023 was primarily driven by events in the wind and solar sectors, namely notable cost inflation, higher interest rate environment, and slower than expected demand.

We believe we’ve reached the end of these fundamental headwinds across wind and solar. In wind, positive order momentum in onshore wind, record day rates for offshore installation vessels, and better volume and pricing set at offshore auctions, all support the outlook for the sector. Demand for residential solar remains muted in Europe and the US, but installers and equipment manufacturers are pointing to growth following a tough Q1.

III. Misplaced concerns about a Trump win

The market was concerned about the implications of a Trump election for the energy transition sector. However, we believe the worries about a potential negative impact for the sector, with Trump’s recent re-election, are overstated and already priced into stocks.

If Trump decides to roll back support for renewables under the Inflation Reduction Act, stocks in those sectors could see a pullback8, however the Republican Speaker of the House, Mike Johnson, said in September that if elected, they would “..take a Scalpel to the IRA rather than a sledgehammer”9.

IV. An uptick in M&A activity in the clean energy space

In recent months, different companies have been acquired at a premium compared to their trading prices prior to the acquisition announcements.

To name an example, Encavis, one of Europe’s largest independent power producers, with a generation portfolio of solar and wind parks in Europe, was acquired at a premium of +30% by KKR, a large private infrastructure player.

More and more acquirers will recognise the strategic value of renewable energy assets. In our opinion, these recent deals may set a positive marker for other transactions in the space.

Outlook and positioning

Our investment team at KBI Global Investors has leveraged market dislocation to add higher quality companies with resilient earnings to their portfolio, to ensure solid exposure to secular drivers. We see ample opportunities to invest in stocks poised for recovery at attractive valuations.

With the world’s major economies committed to achieving net-zero emissions in the long-term, we’re in the early stages of a multi-decade energy transition. The need to decarbonise global economies will lead to substantial investment and growth opportunities for companies that provide decarbonisation solutions across many markets.

We believe the energy transition will remain on track despite the prospect of the global economy slowing, helped by several tailwinds:

- increasing global renewable energy capacity

- energy resilience

- grid investments

- increasing load growth demand

- US Federal government stimulus spending.

While the market is concerned over a potential global recession and a contraction in economic activity, portfolios exposed to secular growth themes supported by long-term tailwinds of supportive regulation, policy, and packages, should be well positioned to deliver strong performance.

Discover the energy transition solutions

KBI Global Energy Transition Fund

KBI Global Sustainable Infrastructure Fund

1 https://www.eia.gov/energyexplained/electricity/electricity-in-the-us.php

2 Cop28, 2023.

3 IEA, 2024.

4 COP29 climate talks end with $300 billion annual pledge, Guterres calls deal a ‘base to build on’ | UN News

5 IEA, 2024.

6 Silicon Republic, 2024.

7 IEA, 2024.

8 Amundi Investment Institute, November 2024.

9 CNBC, September 2024.

Unless otherwise stated, all information contained in this document is from Amundi Asset Management S.A.S. and is as of 19 December 2024. Diversification does not guarantee a profit or protect against a loss. The views expressed regarding market and economic trends are those of the author and not necessarily Amundi Asset Management S.A.S. and are subject to change at any time based on market and other conditions, and there can be no assurance that countries, markets or sectors will perform as expected. These views should not be relied upon as investment advice, a security recommendation, or as an indication of trading for any Amundi product. This material does not constitute an offer or solicitation to buy or sell any security, fund units or services. Investment involves risks, including market, political, liquidity and currency risks. Past performance is not a guarantee or indicative of future results.

Date of first use: 19 December 2024

Doc ID: 4092622

Marketing Communication – For Professional Clients only