Key takeaways

- Urgent investment need: With the global population projected to reach 10 billion by 2050, significant investment in water resources is essential to meet rising demand.

- Driving megatrends: Key megatrends, including inadequate supply, increasing demand, and regulatory support, are shaping the future of the water sector.

- Technological advancements: Innovations in smart water technology and substantial infrastructure funding are crucial for improving water management and ensuring sustainable practices.

Why consider investing in water?

Central banks have successfully managed to curb inflation and are anticipated to further reduce rates as price pressures diminish. However, some uncertainty remains, and the Federal Reserve may need to adapt to changes in US policies under President Trump.

For investors, promising opportunities may be found in sectors poised to benefit from prevailing themes in the coming years. Water is one such sector, with key themes and trends identified that support this belief.

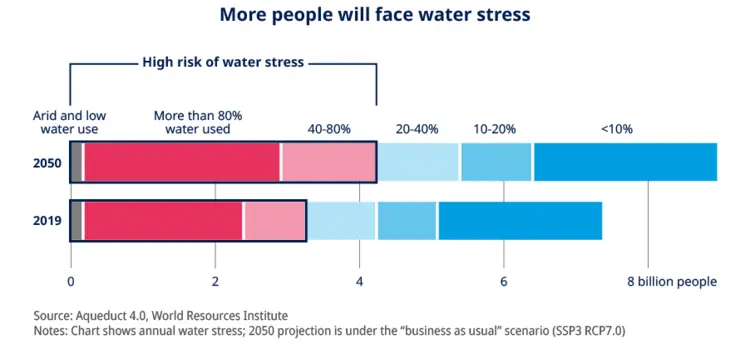

With the global population projected to reach 10 billion by 20501, significant investment will be required to ensure an adequate water supply for everyone. Over the next 20 years, strong demand is forecasted in areas such as desalination, water reuse, filtration and metering. These investment opportunities have the potential to support future alpha generation, other than provide significant diversification benefits within a portfolio.

Five megatrends are expected to drive performance in the water sector. While not new, these trends are becoming increasingly relevant:

| Inadequate supply | Less than 1% of the world’s water is usable and pollution often exacerbates water scarcity in the developing world2. |

| Increasing demand | Water use has been growing at more than twice the rate of population increase in the last century3. |

| Increasing regulation and government support | Many communities need to rethink and prioritise their water supply. Authorities recognise the importance of water security and quality, so regulation will continue to be a strong source of support. |

| Infrastructure investment | An estimated $5 trillion will be required by 20304 to address the urgent global need for water and water services. |

| Investment in technology | Technology is key to water delivery and quality. New technologies are being developed to enhance leak detection and disinfection products, which are expected to play a significant role in water conservation. |

What Trump’s election means for sustainability themes

Unlike 2016, Trump’s election didn’t take markets by surprise. The concern is that his policies may lead to rises in inflation and interest rates if they excessively stimulate domestic growth. On the positive side, he is seen as being pro-business. His presidency is anticipated to benefit America but may have a negative impact on Europe, emerging markets, and China, which are likely to respond.

Although his government is likely to follow an “anti-green agenda”, that shouldn’t affect water investment strategies. Some water-related companies have reduced imports from China since 2018, making them better positioned to benefit if tariffs are increased or new ones introduced.

Water services are essential and companies in the sector tend to display financial resilience during market volatility, thanks to their stable business models, innovation and investment in infrastructure.

High-quality water-related companies have grown over the last couple of years, and have the potential to demonstrate solid operating leverage and earnings growth.

Navigating opportunities in the water sector

Investing in companies that provide solutions to the global shortage of clean water using a precise and pure definition of the water theme is crucial. This approach ensures that the long-term trends identified will be the key drivers of returns.

Key segments in the water sector include:

| Infrastructure | Companies providing pipes, pumps, seals and valves as well as design, engineering and construction services. |

| Technology | Companies providing filtration, disinfection, test and measurement products and metering. |

| Water and wastewater utilities | Companies managing infrastructure and delivery of water and/or treating wastewater for re-use or safe environmental remediation5. |

As we move further into 2025, improvements in business momentum in several sectors should boost these three segments. At KBI, we also see signs of improvement in construction and real estate. More favourable policies and potentially lower interest rates would help these sectors to plug the housing supply gap. There may be an upturn in the industrial sector too. If market sentiment improves, delays in large projects will probably end.

When it comes to infrastructure, government and utility spending markets are strong, and engineering companies are reporting filled order books. In the US, the substantial budgets from the Infrastructure Investment and Jobs Act (IIJA)6 are beginning to be allocated to water projects, and water resources management plans in the UK7 are opening the door for new investments. In Latin America, Brazil announced the Universal Sanitation Act at the end of 2021, which commits to supply sanitation for all by 20338. This will require investment of about $90bn-$130bn. The Act includes a framework, which encourages private market participation and funding.

Water technologies and infrastructure

There are many attractive themes to consider in the water sector. Two of these are smart water and infrastructure stimulus.

Smart water: harnessing technology for efficiency

This involves using technology and data analysis to improve the efficiency of water management for the benefit of communities. Water companies are overlaying and connecting their analytics on plumbing, hydrants, pumps, meters, boilers, water treatment technologies and irrigation equipment.

Remote monitoring and controls help with predictive maintenance and pre-emptive alerting, which can lower costs, decrease downtime and improve service reliability for the end user.

A good example can be seen in agriculture, which consumes up 70% of the fresh water available9. Demand is growing for technologies that optimize irrigation management. Intelligent watering devices not only reduce water consumption but also enable crop cultivation in challenging soil conditions.

Smart water technologies can automatically improve meter reading and reduce manual work while ensuring accurate billing and better customer service. Smart meter reading can help utilities deal with water losses faster, which reduces costs and helps make water more affordable. Technology advances, such as artificial intelligence and the integration of many solutions into common decision support systems, offer opportunities to deepen customer relationships and solve problems in the water sector.

Estimates6 of the global volume of “lost water” are equal to the annual freshwater withdrawals of Germany, France, Spain, Italy, and the UK combined. New regulatory requirements aimed at fixing this could take effect in the next decade. An EU directive will set leakage rate targets by 202810, and the state of Wisconsin in the US requires water loss control plans from utilities companies11.

Infrastructure stimulus in multiple markets

When it comes to the plans countries are making to adapt to climate change12, water infrastructure takes up about 19% of the investment needed. That’s why it is worth paying attention to companies that can benefit from budget stimuli aimed at improving water distribution infrastructure. Governments can end up financing plans spanning several years or even decades. This provides greater clarity on the potential for profits of the companies involved.

The IIJA in the US allocated relevant resources to expand access to clean drinking water and promote climate change resilience efforts. $50 billion investment alone have been allocated to water infrastructure, the largest investment of this type in American history13. This funding has started to make its way into the order books of engineering and construction companies. It represents a significant step up from previous stimulus packages focused on water infrastructure-related spending.

Outlook for 2025

At KBI, we see a favorable environment for the water sector, as we are witnessing new tailwinds.

Firstly, the utilities and contracts markets are characterized by historically low valuations and promising total returns.

Secondly, the residential and industrial water markets have shown resilience:

- High-quality companies have been performing well even in flat or declining markets, with potential for solid operating leverage and earnings growth.

- Government and utility spending markets are strong, with increasing backlogs for engineers.

Finally, valuations in the water sector are attractive compared to the broader market. Long-term earnings growth is expected to continue, and we foresee double-digit growth for the year.

Discover our fund

KBI Water Fund

1 Source: World population projected to reach 9.8 billion in 2050, and 11.2 billion in 2100 | United Nations

2 Source: “Water: Our Thirsty World”, National Geographic, April 2010.

3 Source: “Ensure availability and sustainable management of water and sanitation for all” — SDG Indicators

4 Source: Reglobal, https://reglobal.org/green-capex-in-infrastructure/

5 Environmental remediation refers to the process of removing pollution or contaminants from environmental media such as soil, groundwater, sediment, or surface water.

6 The Infrastructure Investment and Jobs Act (IIJA), also known as the Bipartisan Infrastructure Law, is a United States federal law enacted in November 2021. It authorizes $1.2 trillion in funding for infrastructure projects over five years.

7 Source: Environment Agency. A summary of England’s revised draft regional and water resources management plans - GOV.UK

8 Source: DLA Paper, Brazil new basic sanitation legal framework | DLA Piper

9 Source: World Economic Forum, A look at global freshwater distribution and how we can save it | World Economic Forum

10 Source: Wareg, 4 - Navigating the Evolutions of the Drinking Water Directive

11 Source: Public Service Commission of Wisconsin, PSC Water Loss Control

12 Source: S&P Global, https://www.spglobal.com/_assets/documents/ratings/research/101585883.pdf

13 Source: United States Environmental Protection Agency, Biden-Harris Administration Announces $276 Million for Water Infrastructure in California Through Investing in America Agenda | US EPA

Unless otherwise stated, all information contained in this document is from Amundi Asset Management S.A.S. and is as of 12 March 2025. Diversification does not guarantee a profit or protect against a loss. The views expressed regarding market and economic trends are those of the author and not necessarily Amundi Asset Management S.A.S. and are subject to change at any time based on market and other conditions, and there can be no assurance that countries, markets or sectors will perform as expected. These views should not be relied upon as investment advice, a security recommendation, or as an indication of trading for any Amundi product. This material does not constitute an offer or solicitation to buy or sell any security, fund units or services. Investment involves risks, including market, political, liquidity and currency risks. Past performance is not a guarantee or indicative of future results.

Date of first use: 12 March 2025

Doc ID: 4298773

Marketing Communication – For Professional Clients only