Hedge Fund Investor Barometer

The 2025 Hedge Fund Investor Barometer reveals insights from over 200 investors on risks, opportunities, and the role of alternative investments in portfolio...

We rely on robust processes and strict hedge fund selection methodologies to offer access to competitive managers and innovative solutions.

By relying on our hedge fund platform, you benefit from:

Launch of the liquid alternative platform

in AuM1

dedicated investment professionals

Absolute return and attractive risk/reward profile

Our hedge funds investments seek to improve investment performance and minimize down risk exposure. They aim to generate uncorrelated returns to market risks based on managers’ ability to identify opportunities.

Portfolio diversification

Our hedge fund managers offer long and short exposure to a broad range of asset classes, regions, sectors, styles, factors or maturities.They implement uncorrelated investment strategies using different financial instruments and portfolio management techniques.

Access to experienced managers

Our selected managers have a long-standing trading and risk management experience and have the ability to manage complex strategies

We offer a wide range of hedge fund solutions spanning from off-the-shelf hedge fund strategies under a UCITS format to bespoke customized solutions.

Our offer is complemented by a wide range of advisory services tailored to our clients’ needs.

Our UCITS fund platform partners with high conviction managers selected for their experience and track-record in operating their offshore investment strategies.

We have nurtured privileged relationships with renowned names in the alternative segment, and have the structuring skillset and infrastructure to replicate these strategies in UCITS format.

Our selective range of strategies and high conviction managers:

We take into account our client specific needs and investment constraints at multiple levels, providing them with:

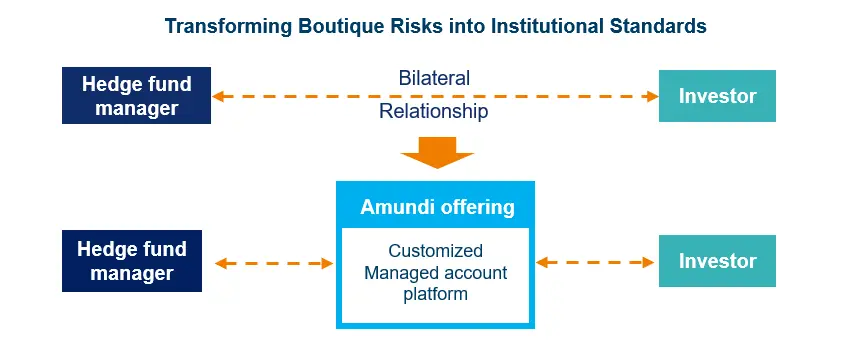

Our dedicated managed account platform offers a secure investment framework for institutional and corporate clients based on performance enhancement and structural alpha.

We regularly share our in-depth hedge funds expertise with our clients to provide them with a greater access to:

1. Source: Amundi AM. figures as of 31/12/2024

This information is exclusively intended for “Professional” investors within the meaning Directive 2014/65/EU of the European Parliament and the Council of 15 Many 2014 on Markets in Financial Instruments (as amended) (MIFID II). It is not intended for the general public or for non-professional individual investors within the meaning of all local regulations, or for “US Persons”, as defined in the Securities and Exchange Commission’s “Regulation S” under the 1933 U.S. Securities Act. This non-contractual information does not under any circumstances constitute an offer to buy, a solicitation to sell, or advice to invest in financial instruments of Amundi or one of its affiliates (“Amundi”). Investing involves risks. The performance of the strategies is not guaranteed. Past performance does not predict future results. Investors may lose all or part of the capital originally invested. There is no guarantee that ESG considerations will enhance a strategy’s performance. The decision of investors to invest in the promoted strategies should take into account all characteristics of objectives of the strategies. All investors should seek professional advice prior to any investment decision, in order to determine the risks associated with the investment and its suitability. Amundi assumes no liability, either direct or indirect, resulting from the use of any of the information contained in this document, and shall not under any circumstances be held liable for any decisions taken on the basis of this information. This information may not be copied, reproduced, modified, translated or distributed, without the prior written approval of Amundi. This information is provided to you based on sources that Amundi considers to be reliable at the date of publication, and it may be modified at any time without prior notice.