The People’s Pension awards Amundi a £20 billion global equi...

Amundi receives a £20 billion climate-focused equity index mandate from The People’s Pension, strengthening its defined contribution pension offerings

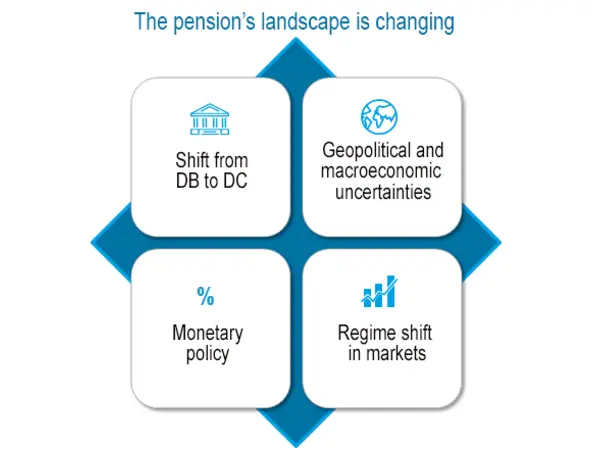

Navigating a complex retirement landscape

Meeting your long-term retirement objectives is made harder by a challenging market environment, ageing populations and ever-evolving regulation.

At the same time, geopolitical and climate change risks are increasing while macroeconomic uncertainty challenges traditional allocations.

We draw on our extensive global insights, resources and experience to support you in meeting these challenges through a complete and innovative asset management offering, tailored to all of your pension needs.

Explore below our effective solutions for all types of pension funds worldwide.

With a full-range of asset classes capabilities for pension funds, we are also specialists at integrating responsible investment across the entire pension value chain.

We offer a full range of investment solutions to meet the long-term needs of defined benefit (DB) pension funds:

We offer capabilities to support defined contribution (DC) schemes and your members in meeting industry challenges through a wide range of solutions:

As a dedicated partner to DB and DC plans, we can support you with advisory offerings and services across your pension fund’s whole value chain:

Our outsourced investment solutions team work with public and private pension funds across the globe to provide strategic advice and assist you in implementation. Our solutions platform aims to understand your distinct needs to:

We offer support on governance and strategy, asset allocation advisory, overlay management, asset or liability modelling and liability benchmark design.

Enhance your capabilities and achieve more impactful investment decisions with our ALTO Technology platforms. Our services offer for pension funds includes:

Enhance your quality of execution and scale your trading capacity with Amundi Intermediation. Our regulated entity is dedicated to best execution and one of the leading providers of buy-side outsourced dealing solutions for all asset classes and geographies.

Responsible investing is at the heart of our investment philosophy

We are committed to helping pension funds navigate the responsible investment landscape.

In addition to a comprehensive range of responsible investment and climate-based solutions, we offer ESG advice and services to support you in achieving your ESG goals:

As Europe’s largest asset manager by assets under management1 we’re a leading provider for pension funds.

Regions of client coverage: Europe, Asia, the Americas, and MEA1

individual pension fund clients2

in AuM2

Your partner in thought-leadership

The Amundi Investment Institute enhances strategic dialogue with clients and cements Amundi's leadership in economic and financial research:

Sharing our knowledge with you

Knowledge sharing is the foundation of our client relationships. We seek to address your specific investment challenges through:

1. Middle East and Africa. Source Amundi, as of end December 2024

2. Source Amundi, as of end December 2024

This information is exclusively intended for “Professional” investors within the meaning Directive 2014/65/EU of the European Parliament and the Council of 15 Many 2014 on Markets in Financial Instruments (as amended) (MIFID II). It is not intended for the general public or for non-professional individual investors within the meaning of all local regulations, or for “US Persons”, as defined in the Securities and Exchange Commission’s “Regulation S” under the 1933 U.S. Securities Act. This non-contractual information does not under any circumstances constitute an offer to buy, a solicitation to sell, or advice to invest in financial instruments of Amundi or one of its affiliates (“Amundi”). Investing involves risks. The performance of the strategies is not guaranteed. Past performance does not predict future results. Investors may lose all or part of the capital originally invested. There is no guarantee that ESG considerations will enhance a strategy’s performance. The decision of investors to invest in the promoted strategies should take into account all characteristics of objectives of the strategies. All investors should seek professional advice prior to any investment decision, in order to determine the risks associated with the investment and its suitability. Amundi assumes no liability, either direct or indirect, resulting from the use of any of the information contained in this document, and shall not under any circumstances be held liable for any decisions taken on the basis of this information. This information may not be copied, reproduced, modified, translated or distributed, without the prior written approval of Amundi. This information is provided to you based on sources that Amundi considers to be reliable at the date of publication, and it may be modified at any time without prior notice.