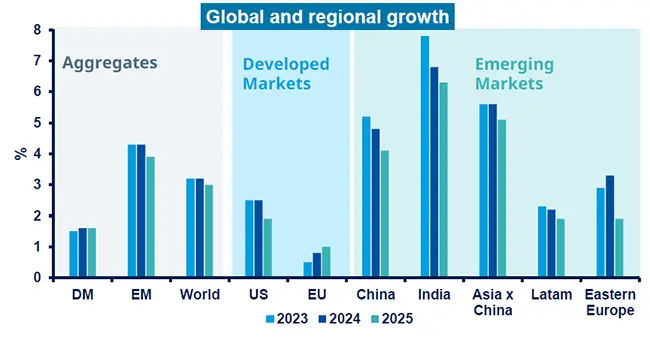

Emerging Markets Gearing Up for Growth

In this shifting world, geopolitical tensions and US election results could reshape emerging markets (EM), offering new opportunities for investors seeking additional sources of returns.

Source: Amundi Investment Institute. Data is as of 14 October 2024. Forecasts are by Amundi Investment Institute and are as of 14 October 2024. EM: Emerging Markets. DM: Developed Markets.

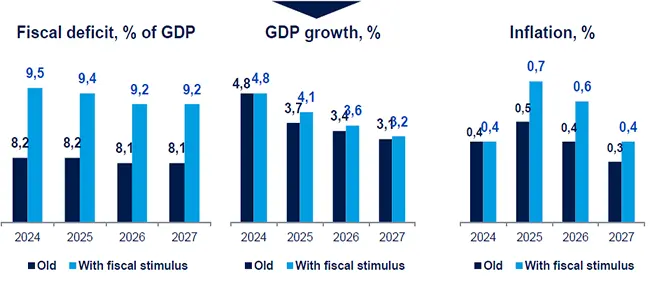

China: policy shifts reversing economic slowdown

Source: Amundi Investment Institute, internal elaboration, data is as of 7 October 2024.

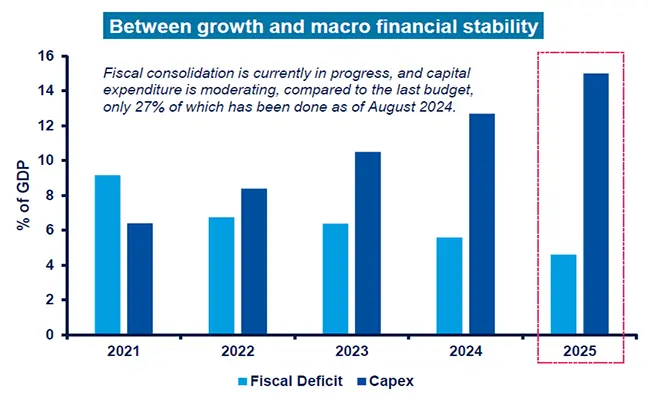

India: economic growth continues to be well sustained

Source: Amundi Investment Institute, internal elaboration, data is as of 17 October 2024. Years refers to fiscal

Indian year.

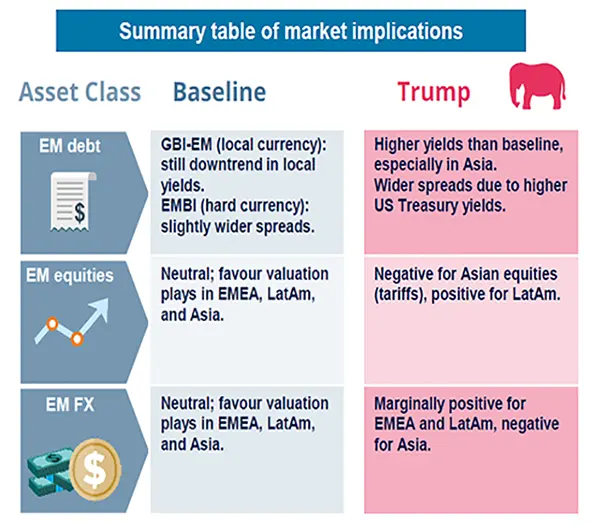

Source: Amundi Investment Institute, as of 10 October 2024. Views reflected on the table above are from Amundi Investment Institute.

Investors seeking opportunities should consider turning their attention to emerging regions, leveraging on significant growth differentials and trade dynamic.

This information is exclusively intended for “Professional” investors within the meaning Directive 2014/65/EU of the European Parliament and the Council of 15 Many 2014 on Markets in Financial Instruments (as amended) (MIFID II). It is not intended for the general public or for non-professional individual investors within the meaning of all local regulations, or for “US Persons”, as defined in the Securities and Exchange Commission’s “Regulation S” under the 1933 U.S. Securities Act. This non-contractual information does not under any circumstances constitute an offer to buy, a solicitation to sell, or advice to invest in financial instruments of Amundi or one of its affiliates (“Amundi”). Investing involves risks. The performance of the strategies is not guaranteed. Past performance does not predict future results. Investors may lose all or part of the capital originally invested. There is no guarantee that ESG considerations will enhance a strategy’s performance. The decision of investors to invest in the promoted strategies should take into account all characteristics of objectives of the strategies. All investors should seek professional advice prior to any investment decision, in order to determine the risks associated with the investment and its suitability. Amundi assumes no liability, either direct or indirect, resulting from the use of any of the information contained in this document, and shall not under any circumstances be held liable for any decisions taken on the basis of this information. This information may not be copied, reproduced, modified, translated or distributed, without the prior written approval of Amundi. This information is provided to you based on sources that Amundi considers to be reliable at the date of publication, and it may be modified at any time without prior notice.