Emerging market winners in a fragmented world

Despite being a key engine of global growth, we believe there are still misconceptions about emerging markets, leading to their underrepresentation in investors’ portfolios.

Watch the video to learn more.

Emerging markets (EM) are crucial for global economic recovery in 2024; this is related to three main themes:

Considering the above, we have a positive stance on EM equities, which should benefit from favourable economic backdrops, strong domestic demand and their attractive valuations (compared to the US).

EM bonds offer compelling yields across the board and should gain from a supportive macro outlook. We maintain a selective approach, with a tilt towards high yielding countries.

Overall, the EM heterogeneity always requires a multidimensional approach to identify opportunities and risks.

India’s economic growth is likely to stay strong on the back of domestic demand. We also think investments will remain robust in the second half of the year. From a fiscal perspective, the government managed to meet and even lower its deficit last year and keep aside some extra spending buffer. This was mainly the result of a generous dividend received from the Reserve Bank of India (RBI). Hence, we think, the government’s desire to increase social spending should not compromise its fiscal consolidation or capital expenditure plans. With headline inflation staying within the RBI’s target range and the start of the easing era for the Fed, the RBI is likely to maintain a prudent policy stance and potentially start easing by the end of 2024.

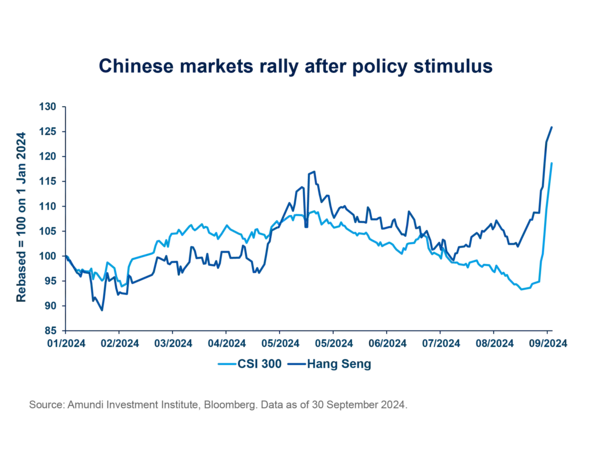

China’s economic growth for H1 2024 has beaten market expectation. Nevertheless, this recovery has been uneven, with net exports significantly boosting GDP, while contribution from investment and consumption declined. Looking ahead to the next months, we believe that the recent series of policy easing measures will support Chinese equities, but the effectiveness of these initiatives in reversing economic challenges will depend on the introduction of robust consumer-oriented fiscal policies.

Thanks to a robust cross-asset EM platform, we can provide investors with one of the most comprehensive offerings in the market. What does our EM investment team focus on? How do we differentiate?

We believe EMD stands out as an attractive investment opportunity being in a macroeconomic sweet spot. How does it offer a compelling case for investors in today's fragmented global landscape?

The asset class has traditionally been perceived as a tactical investment opportunity or as an off-benchmark allocation. Why do we believe EMD should now serve as a core allocation in investors’ portfolios?

Unless otherwise stated, all information contained in this document is from Amundi Asset Management S.A.S. and is as of 27 September 2024. Diversification does not guarantee a profit or protect against a loss. The views expressed regarding market and economic trends are those of the author and not necessarily Amundi Asset Management S.A.S. and are subject to change at any time based on market and other conditions, and there can be no assurance that countries, markets or sectors will perform as expected. These views should not be relied upon as investment advice, a security recommendation, or as an indication of trading for any Amundi product. This material does not constitute an offer or solicitation to buy or sell any security, fund units or services. Investment involves risks, including market, political, liquidity and currency risks. Past performance is not a guarantee or indicative of future results.

Date of first use: 27 September 2024

Doc ID: 3895158

Marketing Communication - For Professional Clients Only