The landscape for income investing has shifted significantly in recent years. After over a decade of yield scarcity, attractive income opportunities are now available across various asset classes. As central banks have moved away from ultra-loose monetary policies, fixed income instruments have started to offer competitive yields. Simultaneously, dividend-paying equities are providing robust income streams, while real assets could represent appealing options for income-focused investors seeking to diversify their portfolios and enhance returns.

Investors may pursue various objectives, yet it is essential for them to strategically select and manage their income-generating assets to build their wealth. This entails not only a focus on retirement readiness through adequate savings but also ensuring that their portfolios are positioned to outpace inflation and support future obligations, particularly given the increasing longevity of individuals.

Key elements for targeting regular income streams

#1: Step away from short-term gains, as they may come at a cost

While it is now possible to capture multiple sources of income – even cash deposits are currently offering compelling interest rates – it is crucial to move beyond temporary, short-sighted options. Keeping money in a bank account, rather than investing it, could represent an opportunity cost, both in terms of missed returns and lost purchasing power over time. Instead, investors should prioritise long-term strategies that align with their investment objectives across diverse market conditions and policy environments.

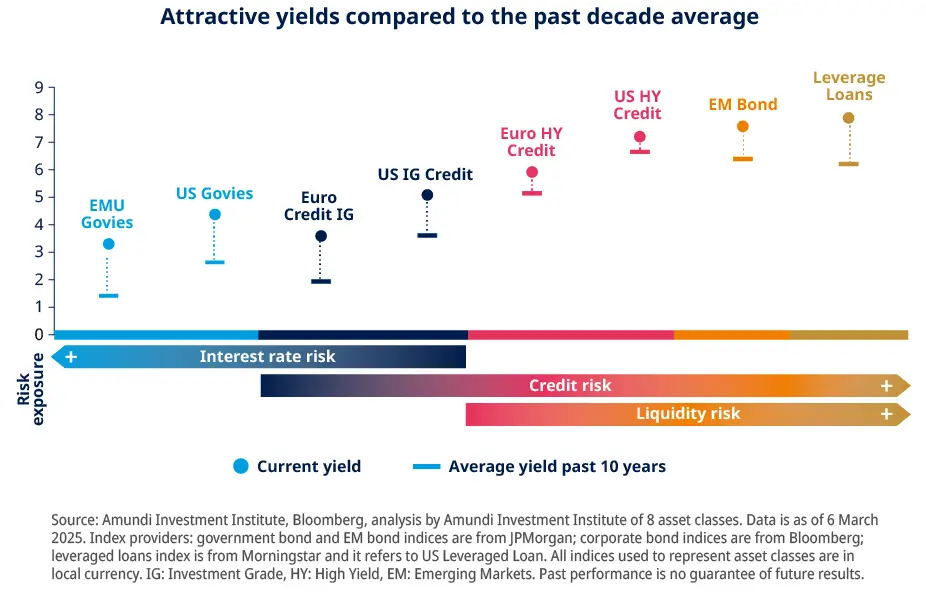

#2: Fixed income as a broader asset class

Fixed income has traditionally been considered a solid foundation for income portfolios. Bonds can typically provide a stable and predictable source of income. In particular, developed countries’ sovereign bonds are often viewed as low-risk investments due to the backing of the issuing government, making them a cornerstone for conservative income strategies. Beyond government bonds, it is important not to overlook the breadth and depth of debt markets, which encompass an extensive number of segments. Corporate bonds can offer higher yields compared to sovereign bonds, reflecting the additional credit risk. Emerging market debt, issued in developing countries, can offer attractive yields and diversification benefits, though they may be subject to higher volatility and geopolitical risks.

#3: Looking outside the “comfort zone” – the importance of diversification

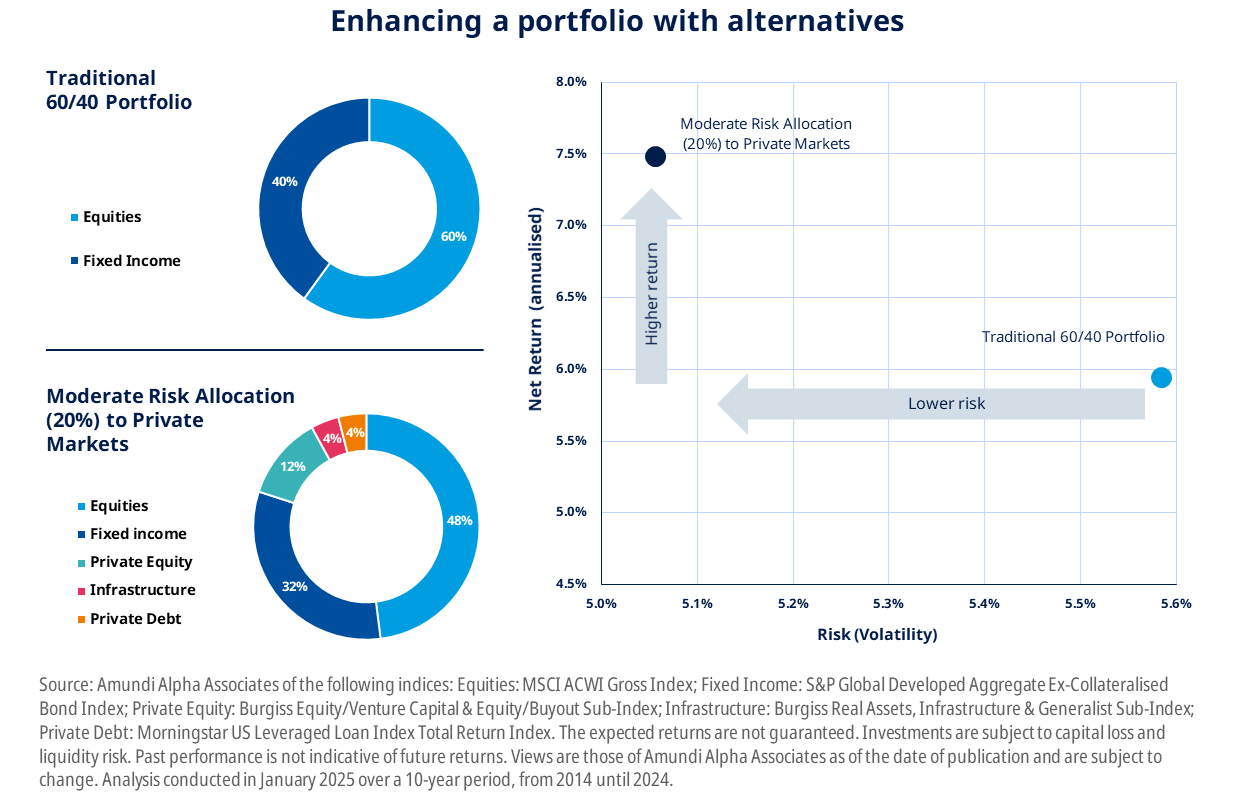

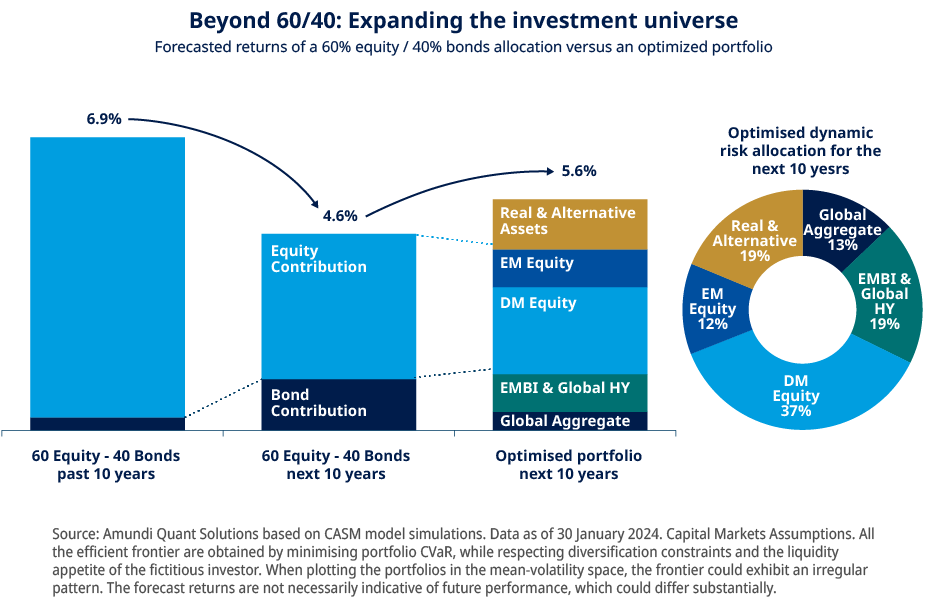

While fixed income investments are often the first option that comes to mind when searching for income, particularly for conservative investors, diversifying into other asset classes can provide additional income streams, enhance capital growth potential, and reduce overall portfolio risk through broader exposure to various sectors and regions.

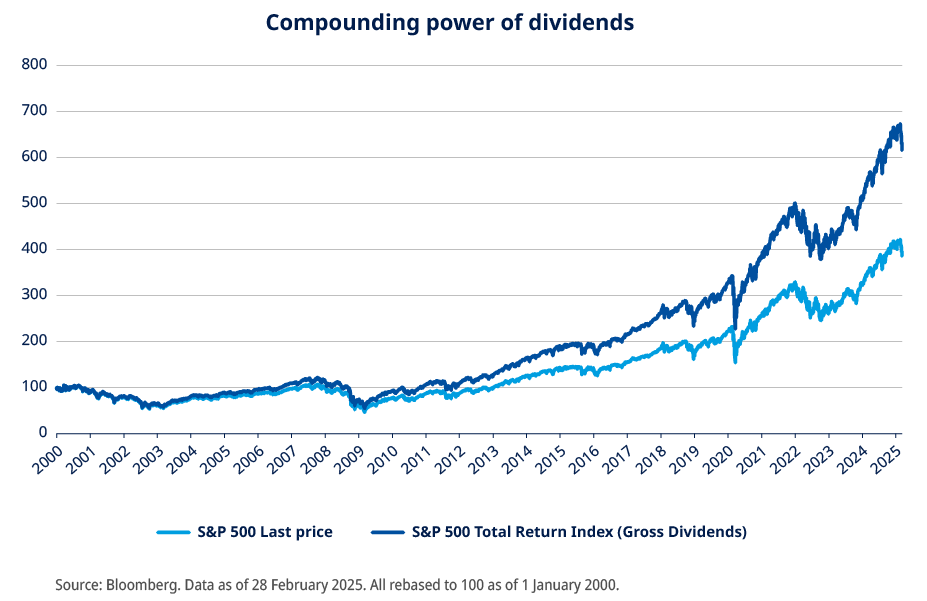

Dividend-paying equities can offer the potential for both regular income and capital growth, representing an attractive option for investors looking to add stability to their portfolios. Companies that pay dividends typically distribute a portion of their earnings to shareholders on a regular basis, thereby offering a steady income stream. Moreover, dividend-paying stocks often belong to well-established, financially stable companies with a track record of profitability. Nevertheless, it is important to remember that equity dividends are not fixed and are paid at the discretion of a company's board of directors.

Income-oriented alternative assets often encompass real assets, such as infrastructure and private markets. These assets can provide diversification benefits, as their performance may be less correlated with traditional financial markets. Therefore, they can help reduce overall portfolio volatility and enhance risk-adjusted returns. Additionally, the long-term nature of these investments can align well with the goals of income-focused investors seeking stable and predictable income streams. However, it is important to note that they are often less liquid than traditional asset classes such as stocks and bonds.

Diversification is key when seeking income. A diversified approach in terms of sectors, regions, and asset classes can help manage market volatility and deliver a smoother return trajectory. A multi-asset approach to income investing not only helps manage risk but also provides flexibility to adapt to changing market conditions. By regularly reviewing and rebalancing, a multi-asset allocation can remain aligned with investors’ income objectives and risk tolerance. This dynamic approach allows to take advantage of new opportunities and respond to market developments, ultimately enhancing the potential for stable and sustainable income.

Why Amundi for income investing

Leveraging a robust track record and a comprehensive range of investment solutions, Amundi stands out as a top-tier option for income investing. With a global presence and deep expertise across various asset classes, we offer tailored strategies aimed at satisfying diverse income needs. Our disciplined investment approach, combined with rigorous risk management, aims to assist investors in achieving their income objectives, whether financing regular expenses or targeting additional income to support their retirement.

| Amundi Fund Global Aggregate Bond |

| Amundi Fund Global Corporate Bond | |

| Amundi Funds US Bond |

| Amundi Funds US Short Term Bond | |

|

| Amundi Funds Euro Corporate Bond Select |

|

| Amundi Funds Global Equity Income Select |

| Amundi Funds Europe Equity Income Select |

| Amundi Funds Income Opportunities |

| Amundi Funds Global Multi-Asset Target Income | |

|

| Amundi Funds Euro Multi-Asset Target Income |

| Amundi Funds Real Assets Target Income | |

|

| First Eagle Amundi Income Builder Fund |

| Amundi Funds Emerging Markets Bond |

| Amundi Funds Asia Bond Income Responsible | |

|

| Amundi Funds Asia Multi Asset Target Income |

|

Read our News and Insights

Diversification does not guarantee a profit or protect against a loss.

Past market trends are not reliable indicators of future ones.

Unless otherwise stated, all information contained in this document is from Amundi Asset Management S.A.S. and is as of 15 April 2025. Diversification does not guarantee a profit or protect against a loss. The views expressed regarding market and economic trends are those of the author and not necessarily Amundi Asset Management S.A.S. and are subject to change at any time based on market and other conditions, and there can be no assurance that countries, markets or sectors will perform as expected. These views should not be relied upon as investment advice, a security recommendation, or as an indication of trading for any Amundi product. This material does not constitute an offer or solicitation to buy or sell any security, fund units or services. Investment involves risks, including market, political, liquidity and currency risks. Past performance is not a guarantee or indicative of future results.

Date of first use: 15 April 2025

Doc ID: 4358301

Marketing Communication – For Professional Clients only