Equity income portfolios combine the pursuit of steady income streams with the potential for capital appreciation. Typically composed of stocks from companies with a strong history of dividend payments, these strategies should target a good level of diversification* to mitigate risks while enhancing income stability.

At Amundi, our investment teams do not limit themselves to the traditional investment universe, seeking opportunities even outside the typical dividend stock industries. This diversified* approach, spanning various sectors and geographies, makes these solutions, in our view, a compelling choice across different market scenarios.

Why invest in equity income products?

Investing in equity income strategies presents several advantages for investors seeking income and stability.

One of the primary benefits of these products is the steady income stream they can provide. By investing in a diversified* portfolio of dividend-paying stocks, they can serve as a consistent source of cash flow. This feature is particularly appealing for retirees or individuals looking to enhance their financial situation through regular income distributions.

Moreover, equity income products often focus on companies that are financially stable and have a proven track record of generating cash flow. This resilience is particularly advantageous during periods of market volatility, as it can help preserve capital and maintain income stability.

A diversified* portfolio of dividend-paying stocks can help effectively manage risk while enhancing overall returns. By consistently returning profits to shareholders through dividends, these companies not only can provide a reliable income stream but also demonstrate financial stability, which can be particularly advantageous during market fluctuation.

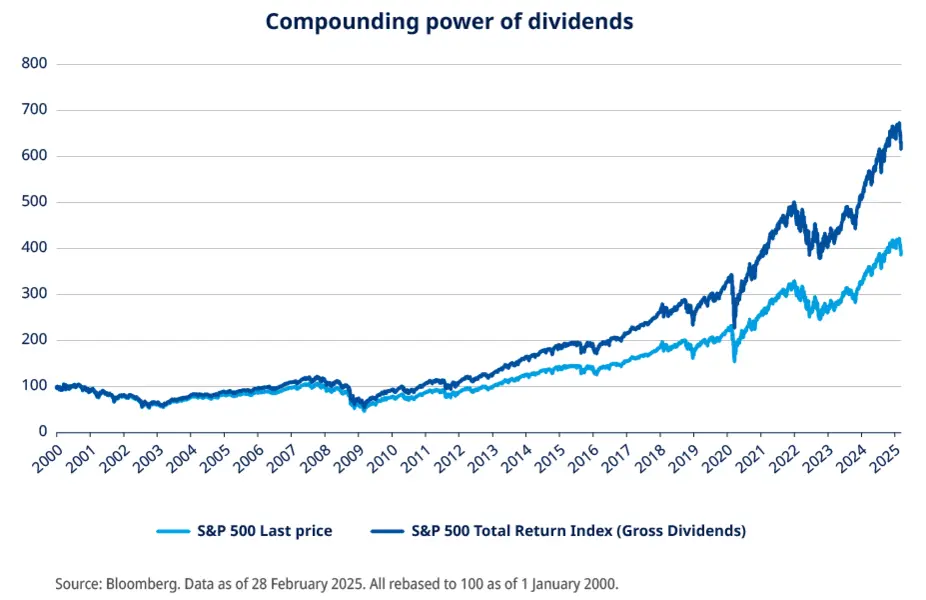

The adage of “time in the markets is more valuable than timing the market” holds especially true in income investing, primarily due to the power of compounding. When you invest in companies that offer an attractive return profile relative to valuations, combined with a stable dividend distribution, the potential for long term wealth creation becomes significant.

Amundi’s approach to equity income investing

In an environment where investors are targeting stability and income streams, dividend-paying stocks can serve as a valuable asset in a diversified* portfolio.

Looking at the investable universe, we believe that companies with strong pricing power—whether through established brand portfolios, valuable intellectual property, or core competencies—are better positioned to protect their profitability. These companies can effectively pass rising costs onto consumers without significantly affecting sales volumes, ensuring that they can continue to deliver sustainable dividends.

To mitigate risks and enhance the stability of income streams, we adopt a diversified* approach in our equity income strategies. By investing across various sectors and geographies, we aim to reduce exposure to specific market fluctuations while maintaining the potential for capital appreciation.

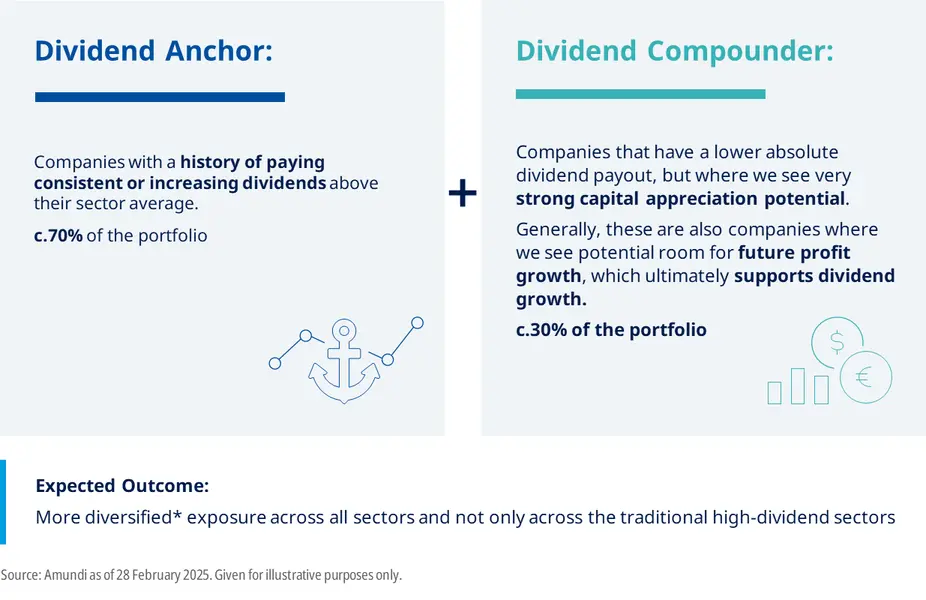

Indeed, our investment strategy emphasizes the importance of selecting both dividend anchors and dividend compounders.

We prioritize companies with strong financial fundamentals that enable them to sustain dividend payments over the medium to long term. Dividend anchors are those firms that have established a track record of paying dividends consistently above the sector average, reflecting solid financial health and a commitment to returning value to shareholders. These are particularly appealing during periods of market volatility, as they provide a dependable income stream and help stabilize investment portfolios.

In addition to dividend anchors, we also focus on dividend compounders—companies that may not offer the highest current yields but possess significant potential for capital appreciation and dividend growth over time. By reinvesting a portion of their earnings, these firms can fuel growth, leading to increasing dividends in the future. This dual focus allows us to align our investment strategy with a real returns mindset, ensuring that our clients benefit from both immediate income and long-term growth potential.

In summary, Amundi’s approach to equity income investing is centered on quality, sustainability, and diversification*, therefore incorporating both dividend anchors and dividend compounders. This approach allows us to provide our clients with a reliable income source while aiming to position their portfolios for attractive total returns over the long term.

Diversified* between “Anchors” & the “Compounders*”

Why Amundi for equity income

With a track record of over a decade in global and European strategies, Amundi is a recognized leader in equity income investing. By diversifying* beyond the highest-yielding names in the market, we aim to provide more well-rounded portfolios that deliver a compelling yield over the long term while managing risk effectively.

In a landscape characterized by uncertainties, we believe that including an equity income product in a diversified* portfolio could be a rewarding decision from a risk-return perspective. At Amundi, we are well-positioned to help our clients navigate the evolving market environment and capitalize on the potential of sustainable dividends.

Discover our equity income solutions funds

Amundi Funds Global Equity Income Select

Amundi Funds Europe Equity Income Select

*Diversification does not guarantee a profit or protect against a loss.

Unless otherwise stated, all information contained in this document is from Amundi Asset Management S.A.S. and is as of 28 March 2025. Diversification does not guarantee a profit or protect against a loss. The views expressed regarding market and economic trends are those of the author and not necessarily Amundi Asset Management S.A.S. and are subject to change at any time based on market and other conditions, and there can be no assurance that countries, markets or sectors will perform as expected. These views should not be relied upon as investment advice, a security recommendation, or as an indication of trading for any Amundi product. This material does not constitute an offer or solicitation to buy or sell any security, fund units or services. Investment involves risks, including market, political, liquidity and currency risks. Past performance is not a guarantee or indicative of future results.

Date of first use: 28 March 2025

Doc ID: 4336950