Investor Account Access

Investor access to Shareowner accounts and Closed End Funds accounts.

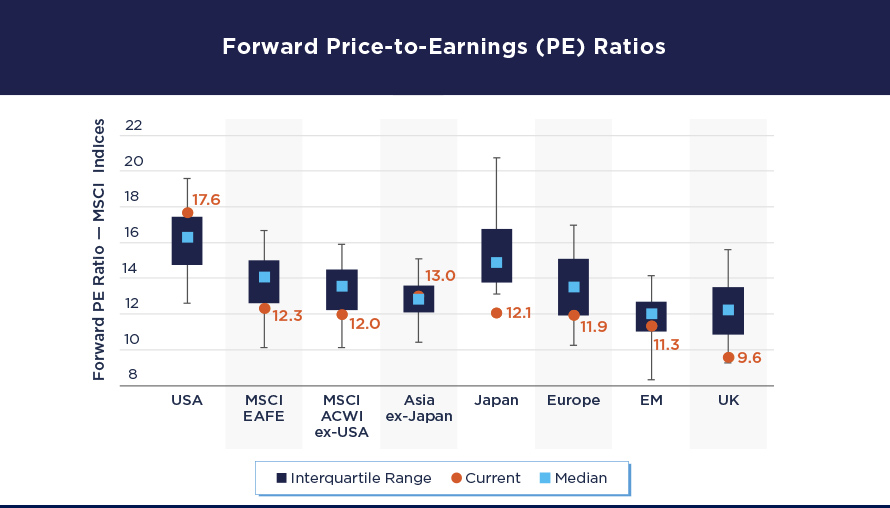

Source: Amundi US, Bloomberg, last data point December 31, 2022. Chart shows Morgan Stanley Capital International (MSCI) indices of the region or country as named accordingly left to right. Each are broad measures of their respective stock markets. Please see Terms and Indices below for more information. Data based on past performance, which is no guarantee of future results.

Equity markets have been adjusting to the reality of a macro shift from quantitative easing (QE) towards quantitative tightening (QT). Ten years of QE has led to market distortions including an outperformance of US equities, specifically large growth stocks.

However, since late 2021, central banks been moving interest rates higher in a battle against decade-high inflation, leading to changes in valuations that have radically shifted the investment opportunity landscape.

In the chart, the blue bars show the range that price-to-earnings, a measure of expensiveness, have traveled over the last 20 years. The light blue squares show the median of that movement. The orange dots show where valuations currently reside. As we can see, non-US international stocks are less expensive than US stocks.

We believe other economic factors also present opportunities for international stocks. These include a US dollar that has started to weaken, a European economy that is faring better than feared, and a reopening of China that could benefit both Asian and European countries.

A multi-asset income approach to investing can potentially offer investors expanded sources of total return as well as income by aiming to seek out the best opportunities across the globe in both stocks and bonds. Risk involves not just which securities to buy, but when to buy them, a principle that applies to both selection and asset allocation. We believe that in today’s quickly changing economic environment, actively managed portfolios offer an advantage over passive or indexed portfolios to help minimize risk and capitalize on opportunities.

In this environment, we believe an active approach to investing may be advantageous. Amundi US offers global investment opportunities to investors.

Terms and Indices

MSCI ACWI Ex US = Morgan Stanley Capital International All Country World Index minus the US. EAFE covers developed market regions of Europe, Australasia, Israel and the Far East. EM = Emerging Markets. Analysis is based on quartile ranking of forward PE over 20 years beginning 12/31/2002. The interquartile range is the difference between the 1st and 3rd quartiles. The black line “whiskers” show the range of the 10th – 90th percentiles.

Indices are unmanaged and their returns assume reinvestment of dividends and do not reflect any fees or expenses. It is not possible to invest directly in an index.

Unless otherwise stated, all information contained in this document is from Amundi Asset Management US (Amundi US) and is as of 12/31/2022.

A Word About Risk: Pioneer Multi-Asset Income Fund

The market prices of securities may go up or down, sometimes rapidly or unpredictably, due to general market conditions, such as real or perceived adverse economic, political, or regulatory conditions, recessions, inflation, changes in interest or currency rates, lack of liquidity in the bond markets, the spread of infectious illness or other public health issues or adverse investor sentiment. All investments are subject to risk, including the possible loss of principal. Pioneer Multi-Asset Income (“MAI”) Fund has the ability to invest in a wide variety of securities and asset classes. Equity-linked notes (ELNs) may not perform as expected and could cause the fund to realize significant losses including its entire principal investment. Other risks include the risk of counterparty default, liquidity risk and imperfect correlation between ELNs and the underlying securities. High yield bonds possess greater price volatility, illiquidity, and possibility of default. Investments in fixed income securities involve interest rate, credit, inflation, and reinvestment risks. As interest rates rise, the value of fixed income securities falls. Prepayment risk is the chance that an issuer may exercise its right to prepay its security, if falling interest rates prompt the issuer to do so. Forced to reinvest the unanticipated proceeds at lower interest rates, the Fund would experience a decline in income and lose the opportunity for additional price appreciation. The Fund may invest in mortgage-backed securities, which during times of fluctuating interest rates may increase or decrease more than other fixed-income securities. Mortgage-backed securities are also subject to pre-payments. The Fund may invest in subordinated securities which may be disproportionately adversely affected by a default or even a perceived decline in creditworthiness of the issuer. International investments are subject to special risks including currency fluctuations, social, economic and political uncertainties, which could increase volatility. These risks are magnified in emerging markets. The Fund may invest in inflation-linked securities. As inflationary expectations increase, inflation-linked securities may become more attractive, because they protect future interest payments against inflation. Conversely, as inflationary concerns decrease, inflation-linked securities will become less attractive and less valuable. The Fund may invest in insurance-linked securities (ILS). The Fund could lose a portion or all of the principal it has invested in an ILS, and the right to additional interest and/or dividend payments with respect to the security, upon the occurrence of a trigger event that leads to physical or economic loss. ILS may expose the Fund to issuer (credit) default, liquidity, and other risks. The Fund may invest in floating rate loans. The value of collateral, if any, securing a floating rate loan can decline or may be insufficient to meet the issuer’s obligations or may be difficult to liquidate. The Fund may invest in underlying funds, including ETFs. In addition to the Fund’s operating expenses, investors will indirectly bear the operating expenses of investments in any underlying funds. Investments in equity securities are subject to price fluctuation. Small-and mid-cap stocks involve greater risks and volatility than large-cap stocks. The Fund may invest in Master Limited Partnerships, which are subject to increased risks of liquidity, price valuation, control, voting rights and taxation. The Fund may invest in zero coupon bonds and payment in kind securities, which may be more speculative and fluctuate more in value than other fixed income securities. The accrual of income from these securities are payable as taxable annual dividends to shareholders. The Fund may use derivatives, such as options and futures, which can be illiquid, may disproportionately increase losses, and have a potentially large impact on performance. The Fund may invest in credit default swaps, a type of derivative, which may in some cases be illiquid, and increases credit risk since the Fund has exposure to both the issuer of the referenced obligation and the counterparty to the credit default swap. The Fund and some of the underlying funds employ leverage, which increases the volatility of investment returns and subjects the Fund to magnified losses if an underlying Fund’s investments decline in value. There is no assurance that these and other strategies used by the Fund or underlying funds will be successful. Please see the prospectus for a more complete discussion of the Fund’s risks.

A Word About Risk: Pioneer Global Sustainable Equity Fund

The market prices of securities may go up or down, sometimes rapidly or unpredictably, due to general market conditions, such as real or perceived adverse economic, political, or regulatory conditions, recessions, inflation, changes in interest or currency rates, lack of liquidity in the bond markets, the spread of infectious illness or other public health issues or adverse investor sentiment.Investing in foreign and/or emerging markets securities involves risks relating to interest rates, currency exchange rates, economic, and political conditions.The Fund generally excludes corporate issuers that do not meet or exceed minimum ESG standards. Excluding specific issuers limits the universe of investments available to the Fund, which may mean forgoing some investment opportunities available to funds without similar ESG standards.The Fund is subject to currency risk, meaning that the Fund could experience losses based on changes in the exchange rate between non-US currencies and the US dollar.The market price of securities may fluctuate when interest rates change. When interest rates rise, the prices of fixed income securities in the Fund will generally fall. Conversely, when interest rates fall, the prices of fixed income securities in the Fund will generally rise.The Fund may use derivatives, which may have a potentially large impact on Fund performance.

The views expressed regarding market and economic trends are those of Amundi Asset Management US, Inc. ("Amundi US"), and are subject to change at any time. These views should not be relied upon as investment advice, as securities recommendations, or as an indication of trading intent on behalf of any portfolio.

Investing in mutual funds involves significant risks. For complete information on the specific risks associated with each fund, please see the appropriate fund’s prospectus or fact sheet, available on our literature page.

Individuals are encouraged to seek advice from their financial, legal, tax and other appropriate professionals before making any investment or financial decisions or purchasing any financial, securities or investment-related product or service, including any product or service described in these materials. Amundi US does not provide investment advice or investment recommendations.

Before investing, consider the product's investment objectives, risks, charges and expenses. Contact your financial professional or Amundi US for a prospectus or summary prospectus containing this information. Read it carefully. To obtain a free prospectus or summary prospectus and for information on any Pioneer fund, please download it from our literature section.

Securities offered through Amundi Distributor US, Inc.

60 State Street, Boston, MA 02109

Underwriter of Pioneer mutual funds, Member

SIPC.

Not FDIC insured | May lose value | No bank guarantee Amundi Asset Management US, Inc. Form CRS Amundi Distributor US, Inc. Form CRS