Investor Account Access

Investor access to Shareowner accounts and Closed End Funds accounts.

Y-Share: PGSYX | A-Share: GLOSX | C-Share: GCSLX

We believe by removing geographical limitations, investors may harness the momentum of macro growth trends, aiming to diversify1 across varying sources of alpha2 and potentially obtaining access to a broader range of what we believe are profitable business models with attractive valuations.

Overall Y Share Morningstar RatingTM(out of 149 funds in the Global Large Stock Value Category) |

Morningstar Proprietary Risk-Adjusted Ratings Performance as of 2/28/2025

For more information about Morningstar Star RatingsTM, including methodology, visit our

Strength Across the Board

page.

|

|

|

|

Integrated Investment ApproachWe believe through a combination of top-down evolving macro themes and bottom-up fundamental analysis, we can find opportunities regardless of changing market conditions. |

Reduced ESG Risks

We believe ESG (environment, social and governance) factors are |

An Active Approach

Disciplined risk management at the security, sector country, |

1Diversification does not assure a profit or protect against loss

2Alpha represents excess return relative to the return of the benchmark. A positive alpha suggests value added by the manager versus the benchmark.

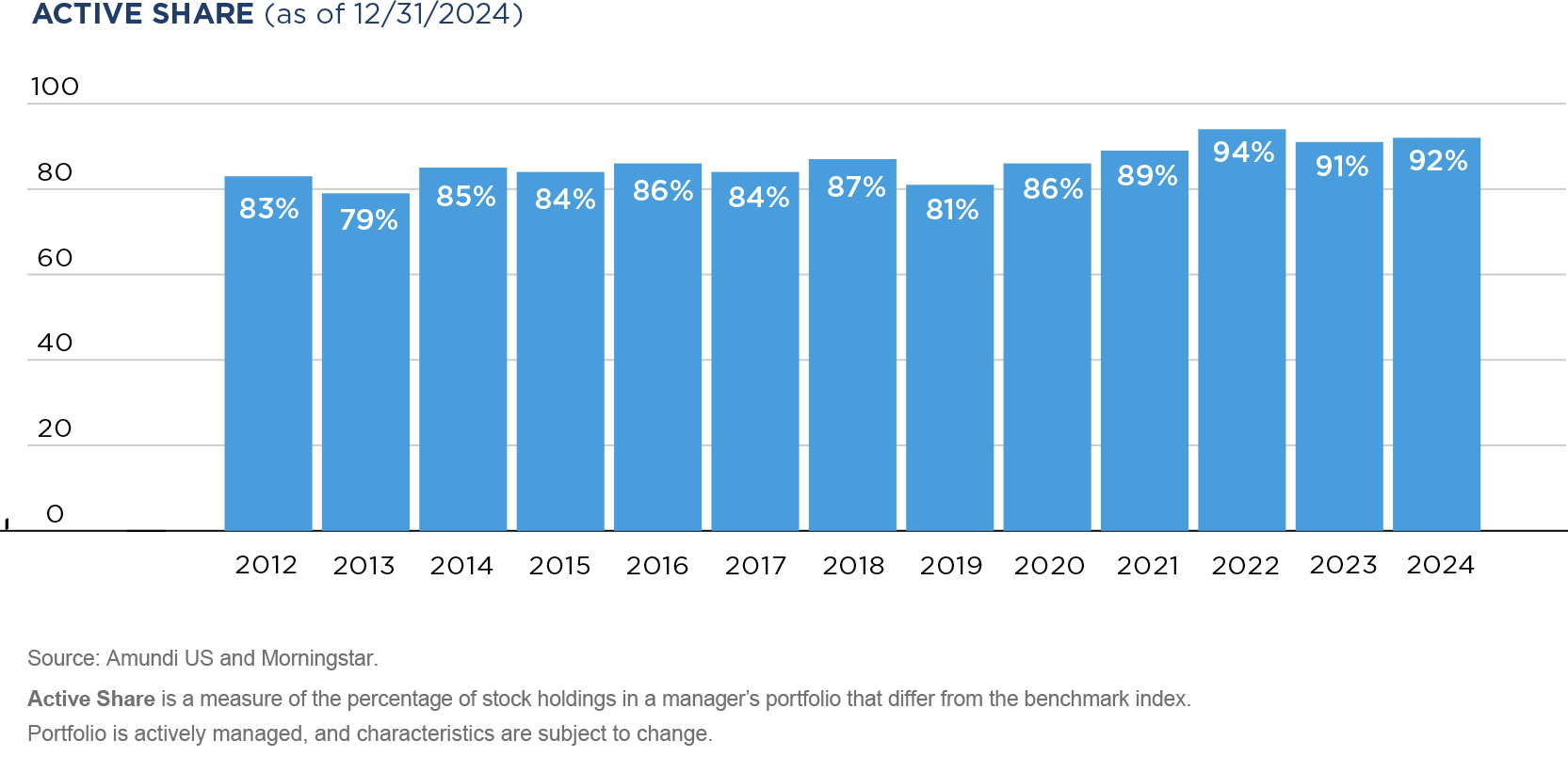

Active share reflects the percentage of stock holdings in a fund’s portfolio that differ from the benchmark index. A higher active share may increase the opportunity for the management team’s insights to have a meaningful impact on performance relative to the benchmark.

By diversifying our active share across companies, sectors and countries, we seek to minimize the risk that any one event will significantly detract from performance.

Average Annual Total Returns as of 12/31/2024 |

||||||

|

1-Year |

3-Year |

5-Year |

10-Year |

||

|---|---|---|---|---|---|---|

| Pioneer Global Sustainable Equity Y Share | 11.90% |

5.87% |

11.78% |

9.21% |

||

| MSCI World Index (Benchmark) | 18.67% |

6.34% |

11.17% |

9.95% |

||

| Morningstar Global Large Stock Value Category Average | 9.43% |

4.85% |

7.23% |

6.80% |

||

Class Y Expense Ratio: 0.75% (Gross); 0.89% (Net).

The Net Expense Ratio reflects contractual expense limitations currently in effect through 1/1/26 for Class Y Shares. There can be no assurance that Amundi US will extend the expense limitations beyond such time. Please see the prospectus and financial statements for more information.

Call 1-800-225-6292 or visit our performance page for the most recent month-end performance results. Current performance may be lower or higher than the performance data quoted. The performance data quoted represents past performance, which is no guarantee of future results. Investment return and principal value will fluctuate, and shares, when redeemed, may be worth more or less than their original cost.

Class Y shares are not subject to sales charges and are available for limited groups of investors, including institutional investors. Initial investments are subject to a $5 million investment minimum, which may be waived in some circumstances. All results are historical and assume the reinvestment of dividends and capital gains. Other share classes are available for which performance and expenses will differ. Performance results reflect any applicable expense waivers in effect during the periods shown. Without such waivers, fund performance would be lower. Waivers may not be in effect for all funds. Certain fee waivers are contractual through a specified period. Otherwise, fee waivers can be rescinded at any time. See the prospectus and financial statements for more information. See benchmark definitions below.

Tickers, CUSIPs

Class A: GLOSX, 72387N705 |

Investment ObjectiveSeeks long-term capital growth Inception Date12/15/2005 |

BenchmarkMSCI World Index* |

*The Fund’s performance benchmark is shown. Information on any additional benchmark for regulatory purposes can be found in the prospectus.

|

||

Fact Sheet |

For more information on Pioneer Global Sustainable Equity Fund, please visit our Download Literature page.

The dedicated global equity investment team benefits from access to our global investment platform. In addition to a team of dedicated global equity analysts, the team leverages the insights of analysts within its centralized US equity research group in Boston as well as over 40 global research analysts located outside of the US, principally in London and Dublin. Further, the team collaborates with Amundi US’ other investment teams located around the world, including the global macro, fixed income and multi-asset teams.

|

|

|

|

|

|

Marco Pirondini |

John Peckham |

Brian Chen |

Jeffrey Sacknowitz |

Paul Jackson |

A Word About Risk: Pioneer Global Sustainable Equity Fund

The market prices of securities may go up or down, sometimes rapidly or unpredictably, due to general market conditions, such as real or perceived adverse economic, political, or regulatory conditions, recessions, inflation, changes in interest or currency rates, lack of liquidity in the bond markets, the spread of infectious illness or other public health issues or adverse investor sentiment.Investing in foreign and/or emerging markets securities involves risks relating to interest rates, currency exchange rates, economic, and political conditions.The Fund generally excludes corporate issuers that do not meet or exceed minimum ESG standards. Excluding specific issuers limits the universe of investments available to the Fund, which may mean forgoing some investment opportunities available to funds without similar ESG standards.The Fund is subject to currency risk, meaning that the Fund could experience losses based on changes in the exchange rate between non-US currencies and the US dollar.The market price of securities may fluctuate when interest rates change. When interest rates rise, the prices of fixed income securities in the Fund will generally fall. Conversely, when interest rates fall, the prices of fixed income securities in the Fund will generally rise.The Fund may use derivatives, which may have a potentially large impact on Fund performance.

The Morgan Stanley Capital International (MSCI) World NR Index (benchmark) measures the performance of stock markets in the developed world. The Morningstar Global Large Stock Value Category Average measures the performance of global large stock funds within the Morningstar universe. The LSEG Lipper Global Multi-Cap Value Category Average measures the performance of funds in the global multi-cap universe. Indices are unmanaged and their returns assume reinvestment of dividends and do not reflect any fees or expenses. You cannot invest directly in an index.

The MSCI information may only be used for your internal use, may not be reproduced or disseminated in any form and may not be used as a basis for or a component of any financial instruments or products or indices. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an "as is" basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each other person involved in or related to compiling, computing or creating any MSCI information (collectively, the "MSCI Parties") expressly disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including, without limitation, lost profits) or any other damages.

(

www.mscibarra.com

)

Individuals are encouraged to seek advice from their financial, legal, tax and other appropriate professionals before making any investment or financial decisions or purchasing any financial, securities or investment-related product or service, including any product or service described in these materials. Amundi US does not provide investment advice or investment recommendations.

Before investing, consider the product's investment objectives, risks, charges and expenses. Contact your financial professional or Amundi US for a prospectus or summary prospectus containing this information. Read it carefully. To obtain a free prospectus or summary prospectus and for information on any Pioneer fund, please download it from our literature section.

Securities offered through Amundi Distributor US, Inc.

60 State Street, Boston, MA 02109

Underwriter of Pioneer mutual funds, Member

SIPC.

Not FDIC insured | May lose value | No bank guarantee Amundi Asset Management US, Inc. Form CRS Amundi Distributor US, Inc. Form CRS

EXP-2025-03-22-ADID-3458041-1Y-T