Summary

Highlights

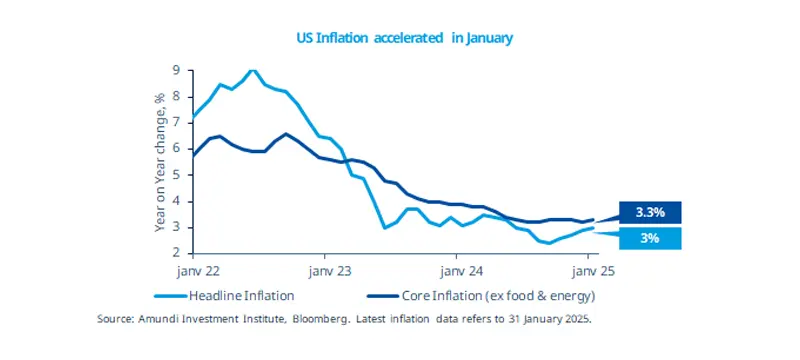

- Inflation will remain sticky in the first half of the year, and should move higher in the second half.

- The new administration’s policy should affect expected inflation, not actual inflation for now.

- The Fed could be patient on holding rates at the current level.

In this edition

January's US Consumer Price Index (CPI) came in above expectations, with a monthly gain of 0.5%, pushing the annual inflation rate to 3.0%. Core inflation, which excludes food and energy, also accelerated. This first inflation report of the year may reflect some seasonal effects, along with annual price increases that typically roll out at the start of the year. Besides the yearly noise, the biggest surprise was in core inflation, driven by strong gains in prescription drugs and used cars. The report highlighted factors that could pose medium-term inflation risks, such as the recent halt in disinflation for housing costs, which may establish a floor for overall inflation. The Fed will likely remain patient.

Key dates

UK unemployment, French inflation, US Empire State manufact

UK inflation, US housing starts and building permits, PBoC Loan Prime Rate (20 Feb)

JP inflation, EZ and UK flash PMIs, US existing home sales

Read more