Summary

In a nutshell

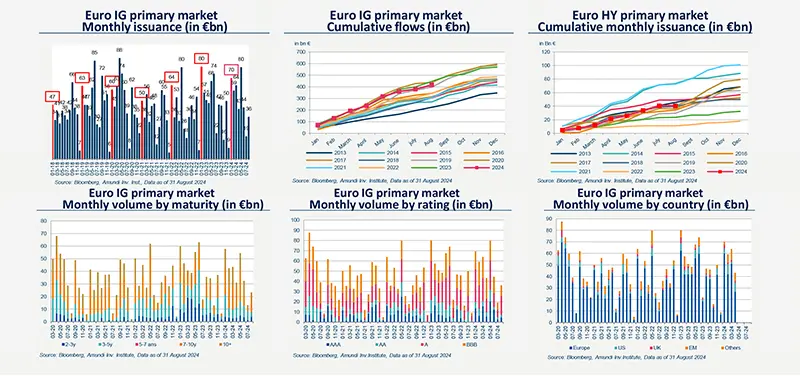

Credit markets remain well oriented: Spreads have retraced a large part of the widening observed during the possible peak in early August. Let us also note: activity in the primary corporate debt market remained solid, particularly in the “Investment Grade” segment.

The pace of GDP growth in the euro zone weakened again in Q 2 2024 (+0.2%). High interest rate levels continue to weigh on economic activity, particularly on demand for credit from businesses.

Good news on the inflation side! Inflation has generally fallen with the fall in energy prices, the end of major disruptions in production chains and the impact of monetary tightening. Annual inflation was 2.2% in July, compared to 2.6% in June. The labor market is less and less a source of inflation. Negotiated wage growth in the euro area slowed in the second quarter, to 3.6% compared to 4.7% in the previous quarter. Additionally, the ECB's Lane expects wage growth to moderate significantly next year.

For the reasons mentioned above, we continue to anticipate three additional rate cuts from the ECB by the end of the year.

Primary market Investment Grade

Market data

Find out about our treasury offer