Summary

In a nutshell

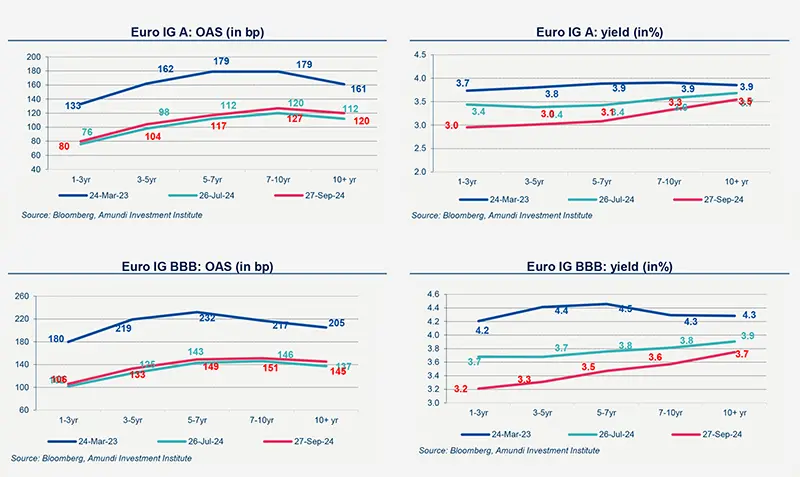

Spreads continued to tighten over the last weeks. The global picture remains positive for credit markets: growth is slowing but economic activity remains resilient and falling inflation is allowing central banks to reduce their rates.

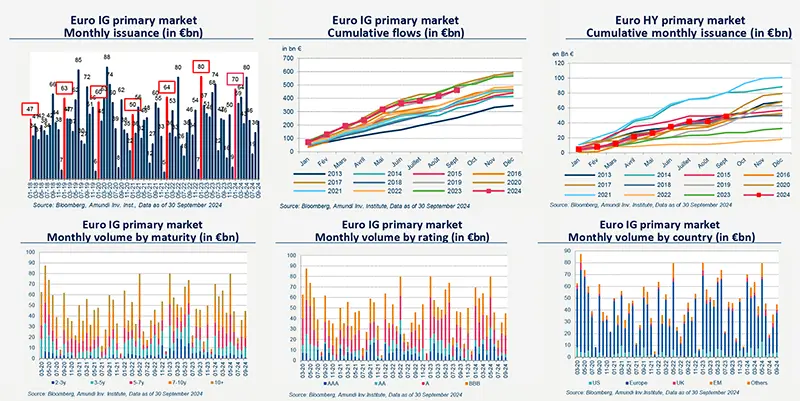

Demand for credit products remained robust. Investors want to take advantage of higher yields before central banks cut rates. Year-to-date, cumulative flows into IG funds and EUR ETFs are the strongest in the last seven years, with demand primarily targeting long-duration instruments and remaining resilient to temporary spikes in volatility. The EUR HY finally showed some capital inflows after a more mixed trend.

In this context, primary market activity remains strong both in the United States and in Europe. Companies continue to take full advantage of investors' strong appetite for fixed income products.

Major risks to credit markets remain:

- Downward revision of GDP growth. We are closely monitoring the impact of monetary tightening which could continue to be felt at the end of 2024/2025.

- Persistent inflation which could call into question expectations of rate cuts. We are attentive to the evolution of geopolitical risk and the political context. Trump coming to power could, as well, lead to more inflationary pressures

Primary market Investment Grade

Market data

Find out about our treasury offer