Summary

In a nutshell

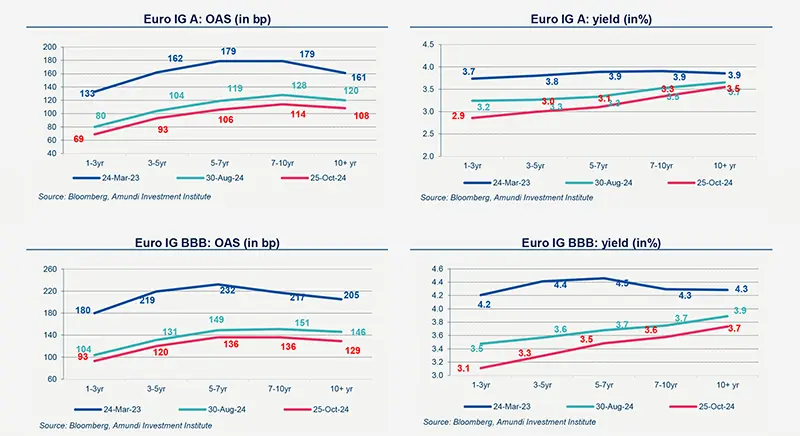

Spreads continued to tighten over the last weeks. The global picture remains positive for credit markets: growth is slowing but economic activity remains resilient and falling inflation is allowing central banks to reduce their rates. We expect another interest rate cut from the ECB by the end of the year. Inflation is declining and downside risks to European growth have increased with the election of Trump.

Demand for credit products remained robust. In October, inflows was strong both for Investment Grade and High Yield. Investors want to take advantage of higher yields before central banks cut rates.

Major risks to credit markets remain:

- Downward revision of GDP growth and/or

- Persistent inflation which could call into question expectations of rate cuts. Trump coming to power could lead to more inflationary pressures in the United States and downside risks to growth in the Eurozone.

Primary market Investment Grade

Market data

Find out about our treasury offer