Summary

In a nutshell

-

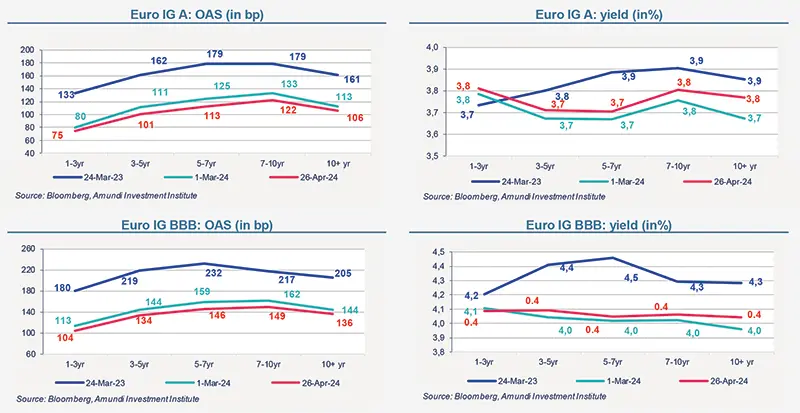

Spreads have tightened in recent weeks after widening from mid-March to mid-April.

Risky assets remain sensitive to (1) the economic outlook and (2) expectations of central bank rate cuts. US inflation, more stubborn than expected, was a source of volatility and forced investors to reconsider their expectations regarding rate cuts from the US Federal Reserve: only 1 to 2 rate cuts are expected this year. -

The EU economy grew 0.3% q/q in Q1-24, beating consensus expectations of 0.1%.

The European economy finds itself in a different context from that of the United States. Inflation now appears to be more or less under control. Indeed core inflation, that is to say adjusted for volatile energy and food prices, slowed from 2.9% to 2.7% in April, after reaching a peak at 5.7% in March 2023. -

The ECB is moving towards a rate cut in June, barring any bad surprises on inflation.

Christine Lagarde indeed indicated that “it would be appropriate to reduce the current restrictive nature of monetary policy” if the decline in inflation towards the 2% target was confirmed. Furthermore, beyond this likely first rate cut, the market could wonder to what extent the ECB could carry out cuts independently of the Fed. -

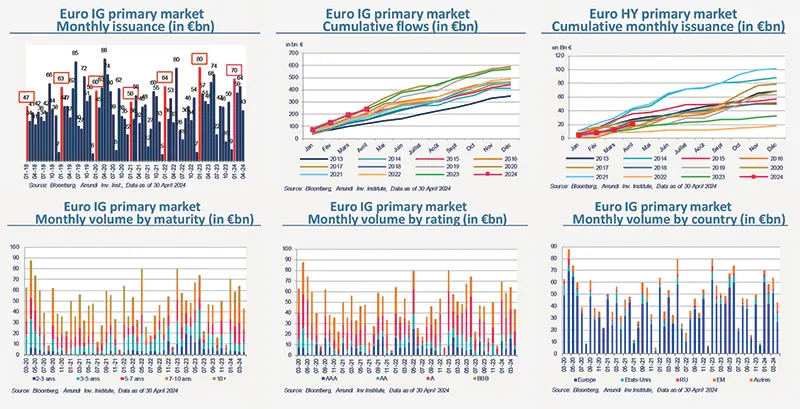

Activity on the primary market remains robust despite rate volatility.

Primary market Investment Grade

Market data

Find out about our treasury offer