Summary

In a nutshell

Credit markets are entering 2025 in a good position.

Credit markets have recorded a positive performance since the start of the year. Spreads have continued to tighten.

Flows into Investment Grade continue uninterrupted in 2025. Once again, short-term IG funds had recorded the lion's share of inflows vs. marginal inflows into long-term IG funds.

The global environment remains positive for credit market. We expect economic activity to remain resilient and inflation to continue to decline. We forecast real GDP growth in euro area at 0.8% in 2025 and inflation to decline to targets in the coming quarters. In this context, the ECB is expected to continue its rate cutting cycle in 2025.

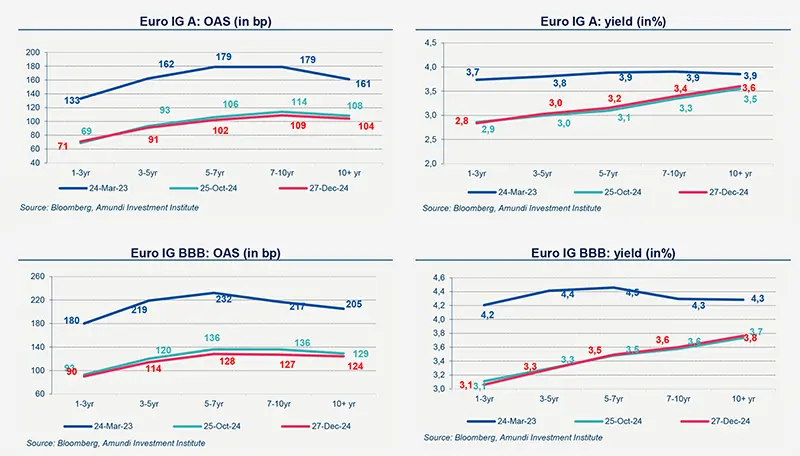

Following the strong performance of 2024, the potential for further spread tightening in Investment Grade and High Yield is more limited. We expect investors to play the carry. Yields are back on long term trends.

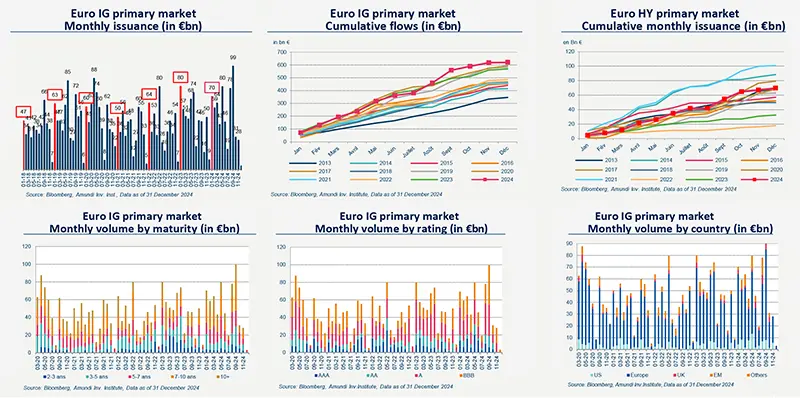

Primary market Investment Grade

Market data

Find out about our treasury offer