Summary

In a nutshell

2024 was a second consecutive very good year for credit markets. 2024 excess returns confirm the outperformance of high beta segments and euro markets: Euro High Yield (6.1%), US HY (5.4%), Euro IG (3,2%) and US IG (2,9%).

We expect 2025 to remain a favourable year for credit markets:

The global picture is positive for credit markets, supported by the combination of resilient economic activity and less restrictive monetary policy thanks to inflation converging towards target. Our biggest concerns are: (1) upside risks to inflation in the United States, notably with rising tariffs, and (2) downside risks to growth in the Eurozone. France and Germany remain key areas of concern.

Corporate fundamentals remain solid. Companies have taken advantage of the post-pandemic period of ultra-low rates and economic recovery to improve their credit profiles. Resilient economic activity means credit quality is to remain solid, especially in HY. The market is now wide open, even for low rated names.

Technical remain supportive. Structurally higher interest rates should continue to support demand for corporate credit from yield-based buyers. Investors want to catch in higher yields before central bank continue to cut.

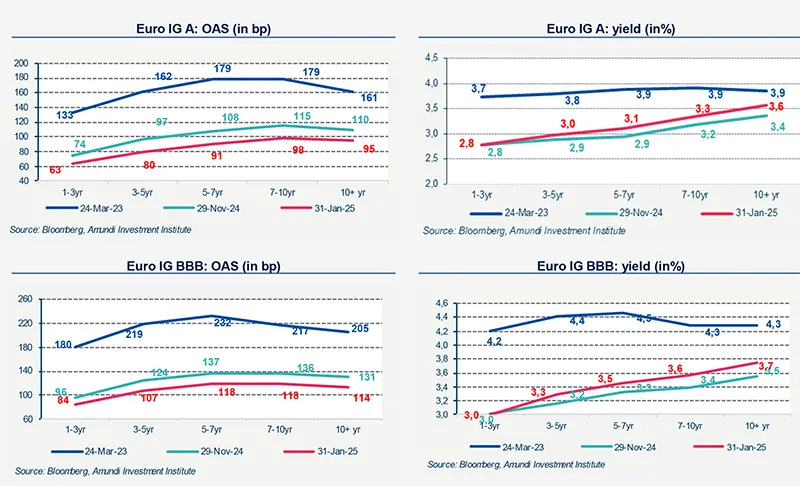

Yield hunting remains the name of the game for most investors. Credit spreads across investment grade and high yield are indisputably tight, but yields remain attractive in line with long-term trends. We expect corporate bonds to continue to be an attractive place to get carry.

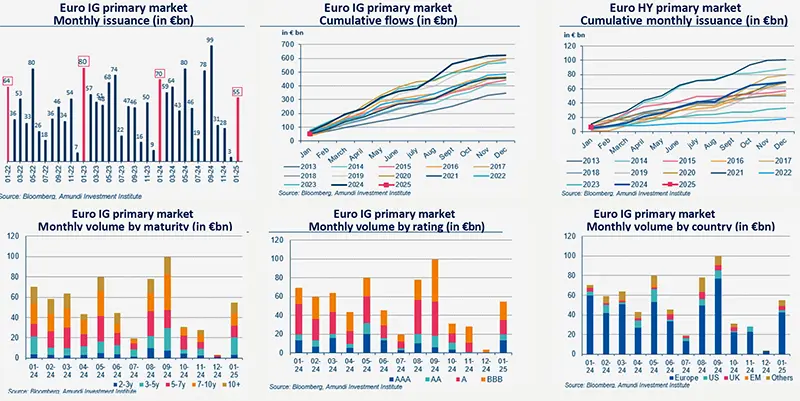

Primary market Investment Grade

Market data

Find out about our treasury offer