Summary

In a nutshell

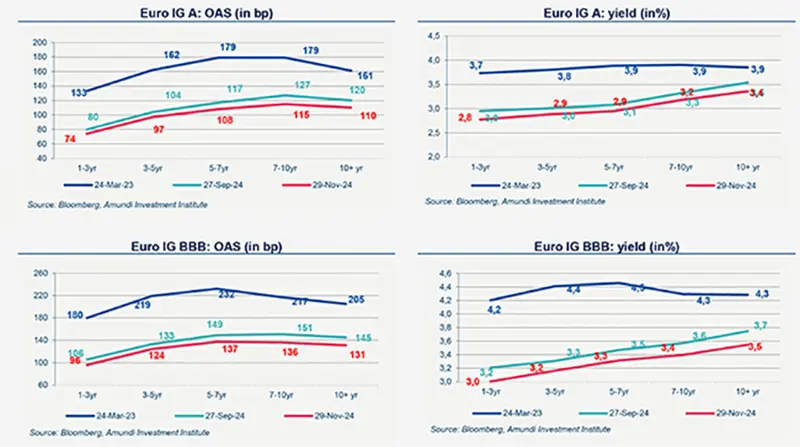

The global picture remains positive for credit market. The ECB is cutting rates in a resilient economic environment. “The direction of travel is clear” and the ECB expects to lower interest rates further. Christine Lagarde acknowledged “risks to economic growth are tilted to the downside” and “darkest days” of high inflation are behind.

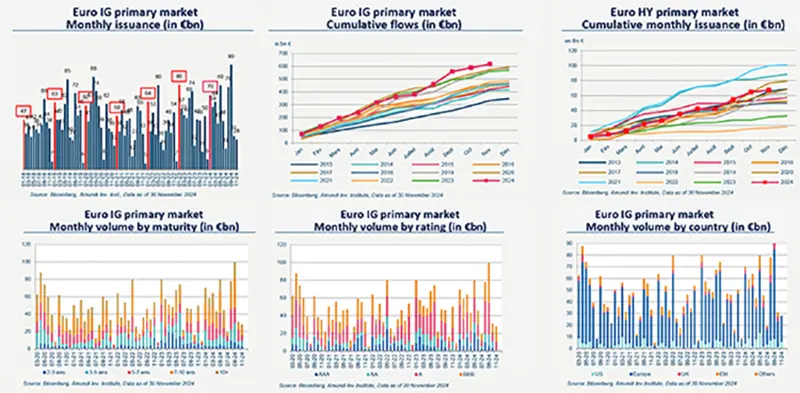

Technical factors remain favorable to credit markets. Investors want to benefit from higher rates before the ECB's further rate cuts. Since the start of the year, the cumulative flows of Euro IG are the largest in the last seven years.

Corporate fundamental remains solid. Corporate default rates are very low and could decrease within 12 months according to Moody's. Default rates had fallen significantly in terms of debt volumes over the last months from already low historical levels: October saw 1.3% in US, 1.1% in Europe. Default remains concentrated in CCC issuers and in SMEs.

Year-to-date, Corporate debt performed positively versus Government debt (Euro IG: 3.3% end Euro HY: 6.3%). Investment Grade yields remain attractive versus historical standards (European IG: 3%). High Yield yields are back to long-term trends (US HY: 7% and European HY: 5.4%).

Primary market Investment Grade

Market data

Find out about our treasury offer