Summary

In a nutshell

The narrative in financial markets has shifted sharply, from a sentiment of "American exceptionalism" to growing concerns about the risk of recession in the United States and a notable slowdown in global growth. The uncertainty generated by the Trump administration's policies is weighing on the US and global economies.

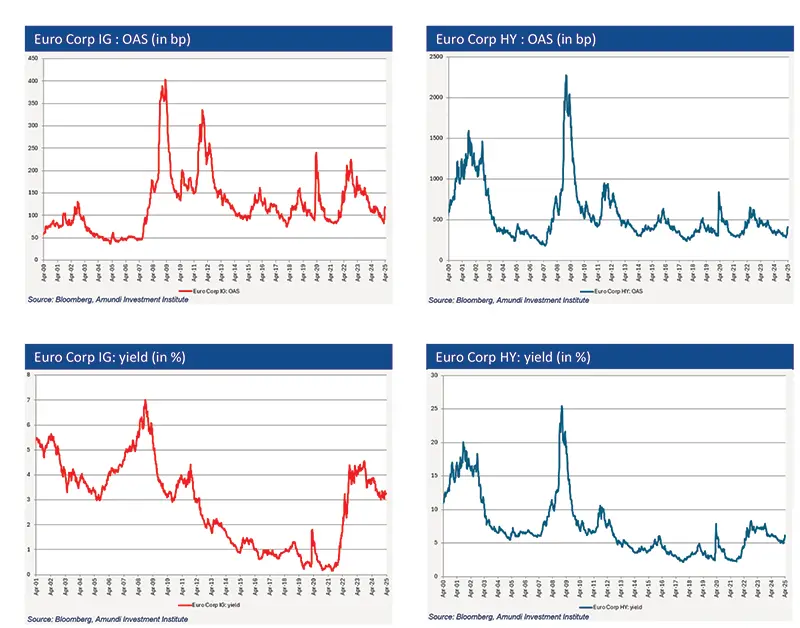

Markets were marked by high volatility in bond markets and a widening of credit spreads. The decline in sovereign yields limited the impact of the widening in credit spreads on issuer yields. In the euro market, the IG spread widened by 37 bps to 120 bps, and that of HY by 129 bps to 404 bps. By contrast, the yield on the 10-year German government bond declined by 40 bps to 2.5%. Ultimately, the yield on the IG segment remained stable at around 3.3%, and that of HY rose from 5.1% at the beginning of March to 6.1% mid-April.

Spreads are resetting to a new regime to reflect slower global growth. Markets have begun to price in a deterioration in credit fundamentals that has not yet materialized and could take several quarters to fully manifest. Lower-rated credits underperformed amid concerns about economic growth.

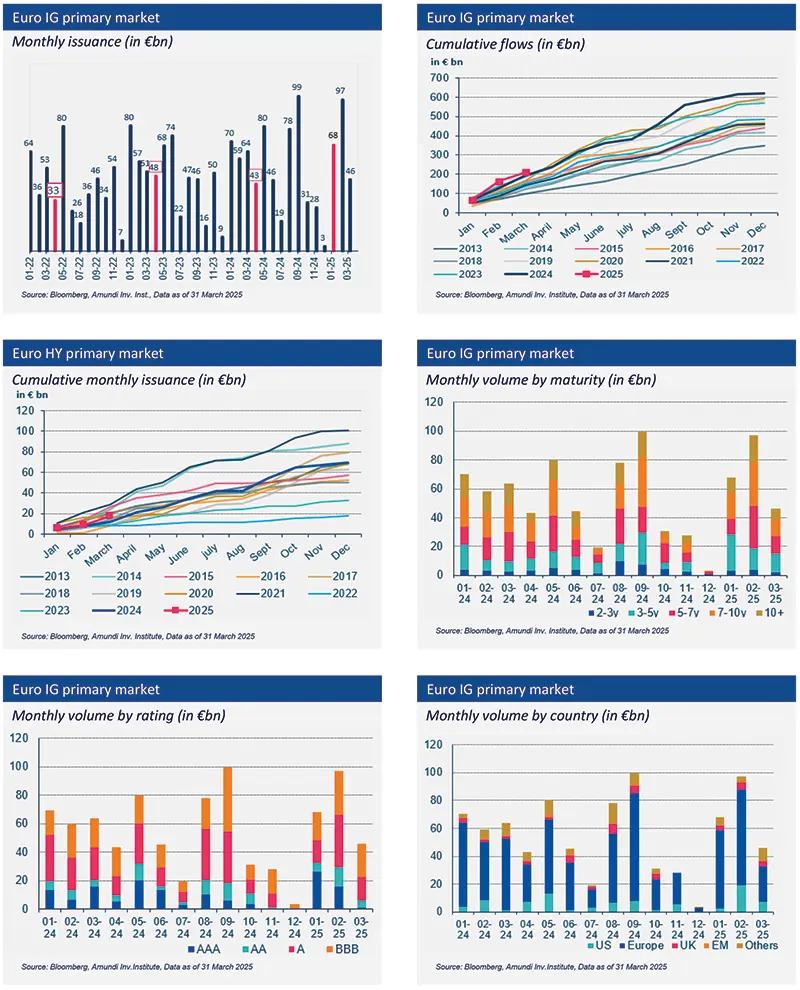

In this context, activity on the primary market has slowed down, particularly for the lowest-rated issuers.

Primary market Investment Grade

Market data

Find out about our treasury offer