Summary

Highlights

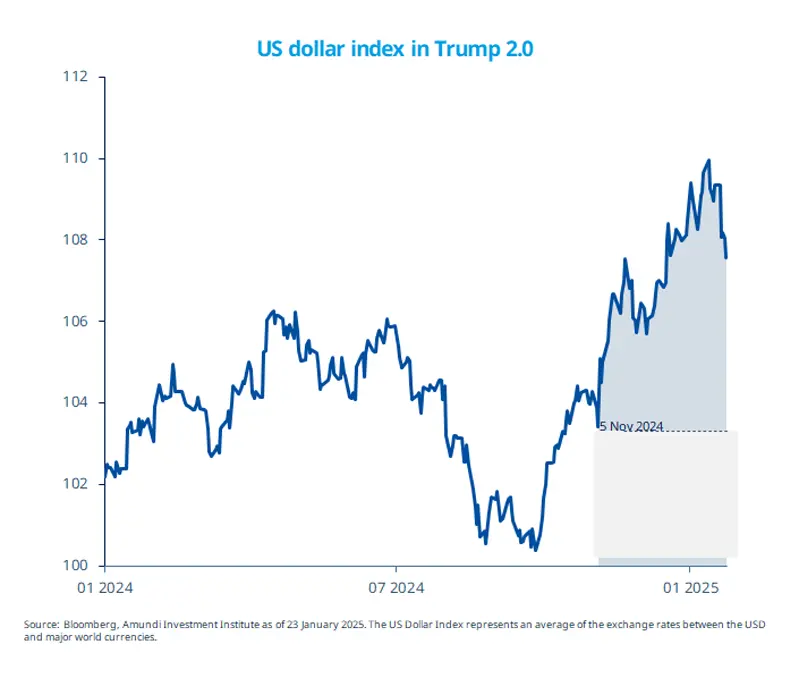

- Markets cheered Trump's first week of his second presidency, as he appeared open to tariff negotiations.

- In early 2025, market sentiment remains supportive, as does the economic backdrop.

- Global equities rose in the week while the dollar slipped as investors sought opportunities elsewhere.

In this edition

Following the US elections, the initial market reaction reflected a sense of US exceptionalism, marked by rising equities and a stronger dollar.

Trump's first week as President aligns closely with his campaign agenda—immigration control, tax cuts, deregulation, and increased protectionism. While not all details have been disclosed, market sentiment remains positive. Equities have rallied, backed by some optimism that not all US imports will be subject to tariffs, and President Trump's stance on tariffs towards China could be softer than initially expected and the US dollar weakened.

We live in a phase of uncertainty regarding policy and tariffs, but the overall economic outlook remains resilient. We look for potential opportunities across global equity markets.

Key dates

Fed interest rate decision

ECB interest rate decision, US Initial Jobless Claims

US Core PCE

Read more