Summary

Highlights

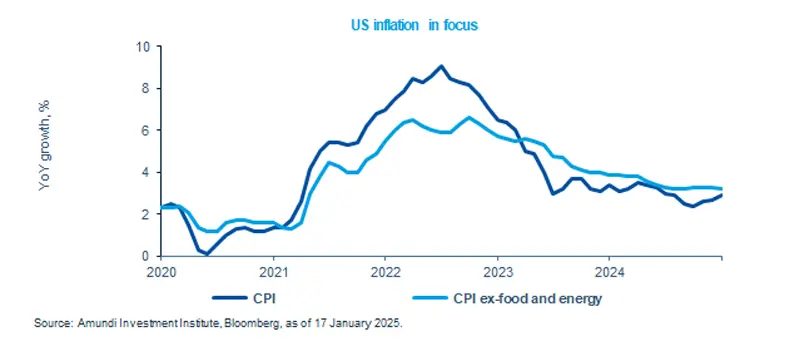

- The lower-than-expected core inflation reading drove bond yields lower, after the previous rise.

- Inflation, Trump’s policy, and Fed expectations are key market drivers.

- We expect uncertainty to remain high entering the Trump 2.0 administration.

In this edition

Inflation news has been a key market driver over the past week, with core CPI (inflation excluding food and energy prices) increasing by only 0.2% in December, lower than both the previous month and below expectations.

More than indicating continued slow progress on reducing inflation, the main impact has been to reduce recent pressure on bond yields and leading to a strong repricing in market expectations on the Fed, with equities also benefitting.

Latest job market data and retail sales confirmed that the US economy remains in a good shape. All eyes will now be on Trump’s policies implementation, which, together with inflation, remain the main theme on the market.

For investors, this calls for keeping a diversified* and balanced allocation, as market swings are likely to increase.

Key dates

China Loan Prime Rate

US Initial jobless claims

Japan Inflation, BOJ decision

Read more