Summary

Highlights

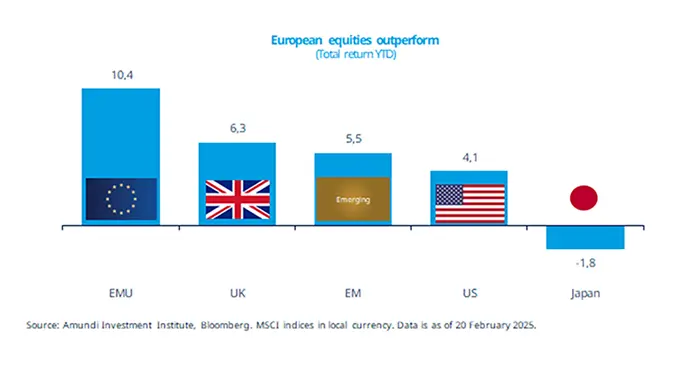

- Outperformance in European equities has been mainly driven by banks, the industrial, and technology sectors.

- A possible ceasefire in the Russia-Ukraine conflict may be supportive for European stocks.

- Expectations of further rate cuts by the ECB would continue to be supportive for European assets.

In this edition

The European equity market has been in the spotlight so far this year, outperforming major global markets, driven by strong performances in the financial sector and more recently in the tech and industrial sectors. The defence segment has seen significant growth due to rising EU defence spending since 2022 and prospects of possible future stronger rises. This possibility has emerged after US Vice President JD Vance’s speech at the Munich security conference, in which he questioned the Transatlantic defence alliance and NATO itself. Expectations for larger defence budgets, potential fiscal stimulus after the German election, and ECB support should help maintain this positive sentiment.

Key dates

US consumer confidence, US house price index, US Dallas Fed index

Germany’s and France’s consumer confidence, US new home sales

EZ inflation data, US personal income and spending

Read more