Summary

Highligts

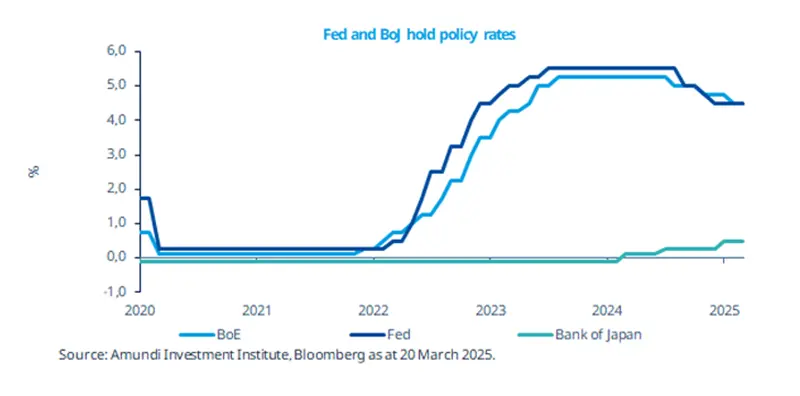

- In light of rising economic headwinds from uncertainty around global trade, the Fed kept a wait-and-see approach.

- Rising uncertainty amid higher US tariffs was mentioned by the BoJ as a factor to keep rates on hold in March. The BoE also left rates unchanged in March due to ambiguity over international trade and a weakening domestic economy.

- The BoE also left rates unchanged in March due to ambiguity over international trade and a weakening domestic economy.

In this edition

The US Fed kept interest rates unchanged in the 4.25-4.50% range at its March policy meeting. Citing risks around elevated uncertainty from trade policies, the Fed prefers to wait and see given that the uncertainty is “remarkably high”. We think partly because of this uncertainty, the central bank slightly reduced its economic growth forecasts for this year and mentioned that US tariff policy may delay progress on slowing inflation. The Bank of England (BoE) and the Bank of Japan (BoJ) also held rates steady. The BoE still expects inflation pressures to ease but reiterated the need for a “gradual and careful approach.“ We think a global approach to quality credit and select bonds could potentially boost prospects for long-term returns.

Key dates

26 Mar US durable goods orders, UK CPI GDP | 27 Mar US GDP, Mexico monetary policy, China industrial profits | 28 Mar ECB CPI expectations, US PCE |

Read more