Summary

Highlights

-

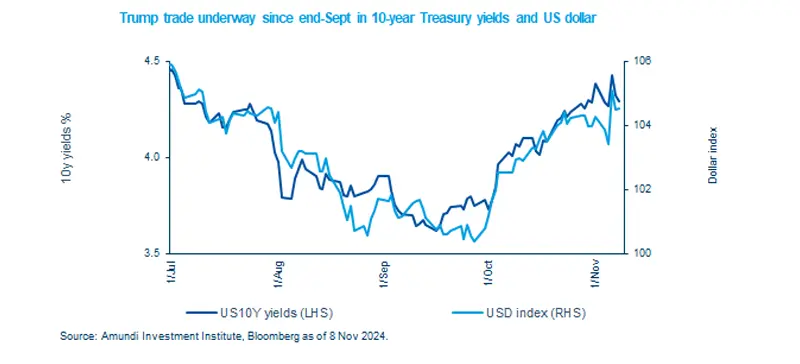

US bond yields and the dollar rose on expectations that new government’s policies could boost economic growth.

-

The Fed, on its part, reduced rates and is likely to continue to ease policy. It would, of course, monitor inflation data.

-

We maintain our no-recession scenario in US and believe consumption is the key variable.

In this edition

Market expectations of Donald Trump’s victory in the US elections have driven bond yields higher since late September. This rise is partly attributed to concerns about Trump’s policies, which could have inflationary effects and exacerbate the already high fiscal deficits and government debt. Additionally, optimism regarding a positive impact on economic growth propelled the US dollar and equities higher, with the S&P 500 reaching record highs on November 6, the day the election results were announced. Looking ahead, while we see some upward risks to inflation, the overall impact on the economy could depend on the sequence of implementation of his policy agenda, in particular regarding tariffs. On the monetary policy side, the Fed has cut interest rates as expected, and it is likely to remain data-dependent, ready to adjust its approach if inflation deviates from its targets.

Key dates

US CPI, France unemployment rate

UK GDP, US PPI, EZ GDP

Japan GDP, China industrial production, US retail sales

Read more