Summary

Highlights

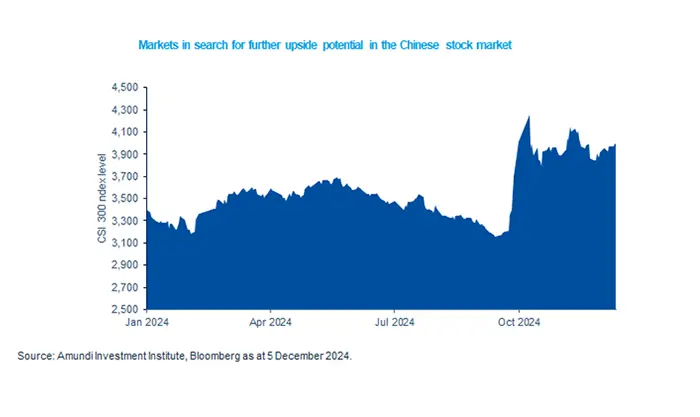

- While volatility may stay high, Chinese policymakers willingness to conduct broad easing is supportive.

- We think under Trump 2.0, increased stimulus is a better approach than trade retaliations or currency devaluation.

- We expect 50 basis points policy rate cuts in the first half of 2025 and additional fiscal spending in 2025.

In this edition

Markets had been waiting for signs of policymakers becoming more accommodative after the initial hint in late September. While we expect volatility to continue, as data such as the latest retail sales, confirm the slowdown, we also note that the leadership has turned to an unambiguous pro-growth stance and willing to conduct broad easing, amid a notable increase of US trade policy uncertainty. The annual Central Economic Work Conference decided that boosting consumption and improving investment returns will be the priority for 2025, by expanding fiscal spending and enhancing monetary easing. While continuing to invest in national strategic projects, the government vowed to increase the consumer goods upgrade programme for households, and to stabilise property and equity markets.

Key dates

China retail sales, India PMI, EZ labour costs

FOMC rates decision, EZ and UK CPI

Bank of Japan rates decision, US GDP

Read more