Infrastructure is favoured due to the energy transition; private equity is recovering; private debt is benefiting from strong bargaining power; the real estate market has stabilised.

Against a backdrop of mildly decelerating economic growth, weakening domestic demand, and interest rate cut expectations, the private market and real estate asset classes can offer relatively attractive investment opportunities as well as risk and return diversification.

We favour infrastructure investment due to its strong growth outlook and steady cash flow. Although volumes remain lower than a few years ago, the market is active Lower interest rate expectations are supporting activity, while the energy transition will drive growth in the years ahead. Governments are supportive of private capital, as it is needed to complement public funding in building renewable energy infrastructure, meeting transport electrification targets, and digitalising activities, as well as supply chains.

Turning to private equity volumes are progressively ticking up, helped by interest rate cuts, while pricing has stabilised. Trading is taking place in high-quality, non cyclical sectors (eg business services, healthcare, and software areas). These are profiting from strong structural growth, pricing power, and robust cash-flow generation. Meanwhile, high valuation multiples in the listed market ensure that the private market’s relative valuation levels are offering more attractive entry points than they were a year ago. As regards private debt, companies are still benefiting from strong bargaining power in negotiating lending contracts, partly due to bank financing remaining constrained albeit this constraint has eased somewhat over the last six months.

Concerning real estate, the outlook for 2025 is more attractive than it was for 2024. Although investment turnover in European commercial real estate is still low, it has increased year-on-year over H1 2024. This was helped by the repricing that had taken place In particular, we have seen signs of stabilisation in prime real estate yields and expect the year-on-year investment volume growth achieved earlier this year by this sector to persist in 2025. However, we anticipate that it will not reach the 2021 level, and the market should remain very segmented. In the leasing sector, rents should benefit from the relatively scarce supply of the most sought-after assets: conversely, the rent outlook for non prime offices is weak. Finally, ESG issues are key, and investors are factoring these into investments’ cash-flow forecasts.

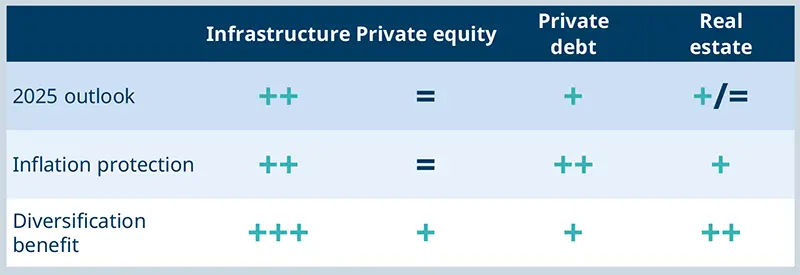

FIGURE 1: Private markets views for H1 2025

Source: Amundi Investment Institute as of 6 November 2024.

Read more