KEY TAKEAWAYS

- Major central banks are expected to relax their restrictive stances during H1 2024.

- This will impact the level of yields available for cash investors, without providing any price upside.

- Short-term bonds could now represent an optimal choice for locking in yields, without adding significant volatility.

Reason #1: An attractive entry point

Reason #1: An attractive entry point

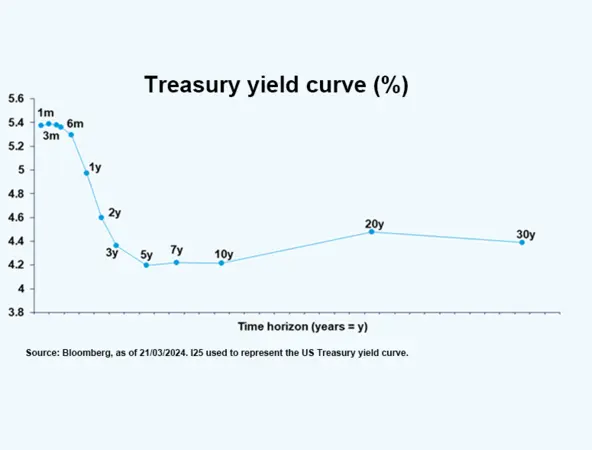

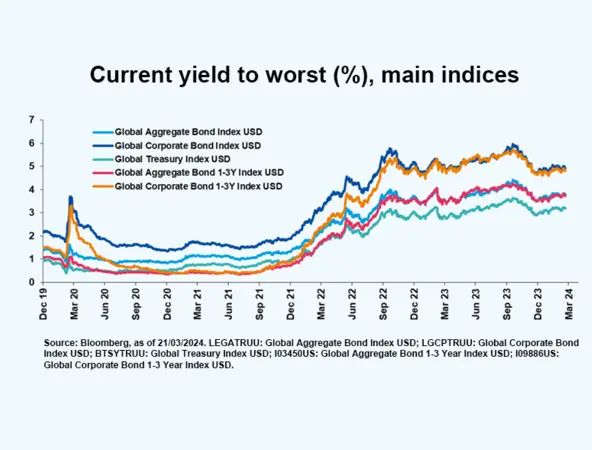

The aggressive hiking implemented by main Central Banks has led to a steep repricing of nominal and real yields; this repricing spurred an inversion of most developed market curves, where short dated bonds yields are now offering higher yields than longer dated bonds.

Reason #2: Low volatility

Short-term bonds are less sensitive to changing interest rates, and therefore typically less volatile. Considering that the current yield levels could provide a cushion for any potential market sell-off, we believe short dated fixed income instruments could be particularly attractive for conservative investors in an environment of heightened geopolitical tensions and economic uncertainties.

Reason #2: Low volatility

Reason #3: Reduced reinvestment risk

Reason #3: Reduced reinvestment risk

Against the interest rate risk inherent in most fixed income securities, investors should consider the reinvestment risk inherent in cash; that is, the chance that cash flows received from an investment will earn less when put to use in a new investment. Shifting exposure from cash to short-term bonds may allow investors to “lock in” much of today’s elevated income levels, which would start declining as soon as central banks start easing their monetary policies.

To conclude, we believe short-term bonds could be an attractive option for investors looking to move out of cash, but rather not willing to substantially change their risk profile: the attractive level of yields currently provided, together with their low volatility and limited reinvestment risk, make these products particularly suited for the current market uncertainty.

Discover our solutions

Short term range of funds

Amundi Funds Global Short Term Bond

Amundi S.F. - Diversified Short-Term Bond ESG

Amundi Funds US Short Term Bond

Longer duration range of funds

Amundi Funds Global Aggregate bond

Amundi Funds US Bond

Amundi Funds Global Corporate Bond

Unless otherwise stated, all information contained in this document is from Amundi Asset Management S.A.S. and is as of 26/03/2024. Diversification does not guarantee a profit or protect against a loss. The views expressed regarding market and economic trends are those of the author and not necessarily Amundi Asset Management S.A.S. and are subject to change at any time based on market and other conditions, and there can be no assurance that countries, markets or sectors will perform as expected. These views should not be relied upon as investment advice, a security recommendation, or as an indication of trading for any Amundi product. This material does not constitute an offer or solicitation to buy or sell any security, fund units or services. Investment involves risks, including market, political, liquidity and currency risks. Past performance is not a guarantee or indicative of future results.

Date of first use: 26 March 2024

Doc ID: #3395271