Positioning ideas for a new market dynamic

-

Bond markets present a prime opportunity in terms of historical yields, providing a favourable environment for investors seeking stable and attractive returns;

-

We believe it’s a good time to own duration, with upcoming capital appreciation opportunities as central banks in developed markets continue their easing cycles;

-

A research-backed, disciplined yet flexible investment approach could help navigate heightened volatility more effectively and enhance diversification;

-

With over 20 years of proven expertise, Amundi offers strategic and tactical solutions to help you navigate through market challenges while capitalising on most favourable conditions.

The final quarter of 2024 has established a new market dynamic for bond investors. Following the great repricing of 2022 and 2023, market focus has moved away from inflation and towards growth.

This shift has been underlined by positive progress in the battle against inflation. At the same time, a cooler US employment environment has prompted the Federal Reserve to start cutting rates, making it the final major central bank to do so and ending the period of policy divergence.

What does this mean for investors?

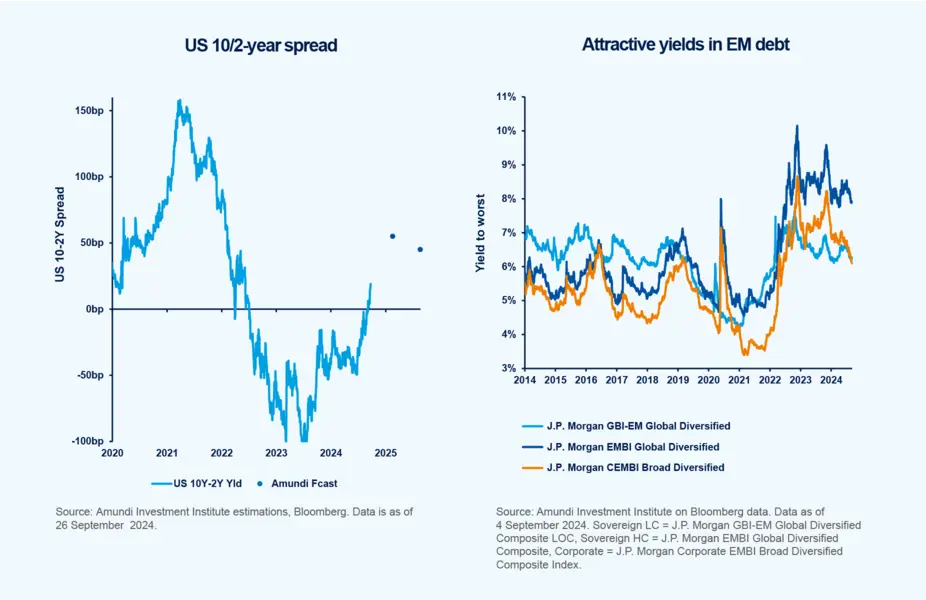

Slowing inflation is positive for bonds and long-term yields are still attractive. Investors could also benefit from regional and curve opportunities driven by the different timing and speed of central bank actions and the positive outlook for emerging market bonds.

However, the current scenario is still characterised by low visibility. The upcoming second Trump Presidency is likely to have a major impact on the growth, inflation and market outlook for the US and the rest of the world. While challenging, this uncertainty allows skilled managers to showcase their ability to generate alpha.

At Amundi, we are expertly placed to help investors benefit from the changing macroeconomic environment. In our view, fixed income should once more be considered a core part of investors’ portfolios, as its ability to deliver attractive risk-adjusted returns could improve portfolio stability, particularly with a decrease in stock / bond correlation in sight.

The yield appeal

Right now, bond markets offer an appealing entry point in terms of historical yields, even after the summer’s repricing of rate expectations and notable flows into the asset class. Global net inflows surged by approximately €830 billion in the first eight months of 20241, of which almost €230 billion for European domiciled funds only2.

But in this more positive environment, we stress the importance of an active approach. Our expert team is constructive on European duration given Eurozone inflation has now dropped below 2% for the first time since 2021. Moreover, with growth prospects in the region remaining very weak, we believe the European Central Bank has room to depart from its gradual approach and should accelerate the pace of rate cuts in 2025. In the US, the Federal Reserve is expected to continue cutting rates, although an increasingly data-dependent approach and the potential effects of Trump’s policies may lead to a less accommodative stance.

We continue to favour steepening strategies. While these have already performed well, thanks to short-term yields having fallen more rapidly, we feel there is still a margin for further steepening as long-term rates could suffer from fiscal pressure in a highly indebted world.

Overall, maintaining a positive view on duration and the steepening of the yield curves are our main convictions in fixed income. However, with deficits potentially placing upward pressure on bond yields, we caution that investors should not ignore near-term market dynamics. Additionally, the trajectory of Trump’s tariff plan is another element to consider.

Corporate credit offers attractive carry potential and should benefit from central bank rate cuts. We favour high-quality investment grade over high yield in both the US and Europe, as we believe companies with strong corporate fundamentals are better equipped to navigate a slowdown.

Emerging markets, led by Asia, are poised to benefit from positive growth differentials versus developed markets. This growth premium should draw greater capital flows into the asset class.

Diversification and flexibility

Although market visibility should increase over time, the current environment is likely to be characterised by high levels of volatility as central banks progress along the easing cycle at different speeds and geopolitical risk remains elevated.

In such an environment, we expect to see many regional and curve opportunities and believe a disciplined and flexible investment approach could help investors ride the curve, by enhancing risk-adjusted returns and increasing diversification.

Why Amundi for fixed income

Amundi is one of the industry leaders in fixed income, with an AuM of over €1 trillion (as at 30 September 2024).

Over the past 20 years, we have developed a comprehensive range of fixed income investment products, from fundamental, rule-based or active approaches to buy and maintain strategies.

The team’s strong skill-set and broad expertise aims to continually seek out the best opportunities, while also evolving to identify new ways to source potential returns.

At Amundi, we are expertly placed to help you benefit from the opportunities presented by this significant macroeconomic shift.

See our fixed income offer

Amundi Funds Global Aggregate Bond

Amundi Funds Global Corporate Bond

Amundi Funds Euro Corporate ESG Bond

Amundi Funds Emerging Markets Bond

Amundi Funds US Bond

1. Source: Broadridge, as of 31 August 2024.

2. Source: Morningstar, as of 31 August 2024

Unless otherwise stated, all information contained in this document is from Amundi Asset Management S.A.S. and is as of 20 November 2024. Diversification does not guarantee a profit or protect against a loss. The views expressed regarding market and economic trends are those of the author and not necessarily Amundi Asset Management S.A.S. and are subject to change at any time based on market and other conditions, and there can be no assurance that countries, markets or sectors will perform as expected. These views should not be relied upon as investment advice, a security recommendation, or as an indication of trading for any Amundi product. This material does not constitute an offer or solicitation to buy or sell any security, fund units or services. Investment involves risks, including market, political, liquidity and currency risks. Past performance is not a guarantee or indicative of future results.

Date of first use: 20 November 2024.

Doc ID: 3933888