Following the post-pandemic inflation surge, and the subsequent monetary policy responses, the economic outlook looks increasingly fragmented.

In our view, this translates in a rare set of opportunities for flexible fixed income investors, ranging from high income to capital appreciation. Yields, currently at historically appealing levels, should start a downward trend soon: a positive view on duration and curves steepening will be our main convictions for fixed income over the coming months.

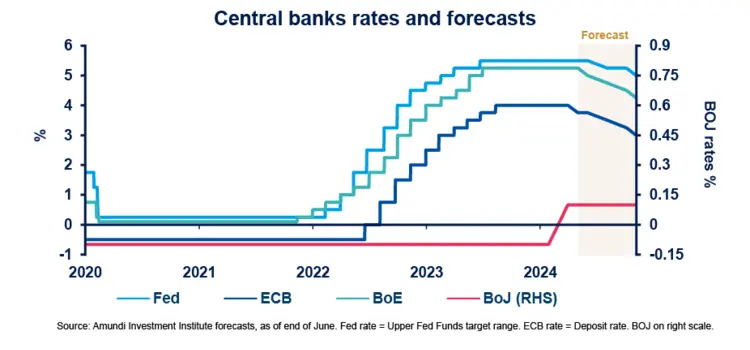

From a sovereign bond perspective, central bank policy divergence is coming into play. In Europe, we have seen central banks in Switzerland, Sweden and the European Central Bank cut rates in recent months. Whereas, it is still not clear when the US Federal Reserve will make a similar move, this shouldn’t take too long to materialise. For the time being, this has led to relative value opportunities.

Our analysis also shows strong potential for corporate bonds. In both the US and Europe, companies have largely been shielded from the higher rate environment as refinancing needs have been relatively low and cash levels remain high. While there may be an uptick in corporate refinancing in the coming years, we expect this to be predominantly among high yield companies and therefore maintain a preference for high-quality credit.

We believe the depth and breadth of the fixed income market – in terms of regions, sectors and currencies – offers an extensive number of investment opportunities, but caution that uncertainty regarding economic, geopolitical and domestic political outlooks means a disciplined and flexible investment approach will be crucial.

Amundi Funds Global Aggregate Bond is particularly well suited to the current market environment, thanks to a number of factors:

- The agility to invest across the full spectrum of global interest rates and credit markets;

- The ability to rotate across regions and sectors;

- The flexibility to tactically manage duration and yield-curve positioning to mitigate interest-rate rate sensitivity;

- The capacity to exploit currency volatility over different market cycles.

Now more than ever, the market requires a particularly selective and agile approach to managing fixed income portfolios.

Learn more about Amundi’s global fixed income offering

Amundi Funds Global Aggregate Bond

Unless otherwise stated, all information contained in this document is from Amundi Asset Management S.A.S. and is as of 24 July 2024. Diversification does not guarantee a profit or protect against a loss. The views expressed regarding market and economic trends are those of the author and not necessarily Amundi Asset Management S.A.S. and are subject to change at any time based on market and other conditions, and there can be no assurance that countries, markets or sectors will perform as expected. These views should not be relied upon as investment advice, a security recommendation, or as an indication of trading for any Amundi product. This material does not constitute an offer or solicitation to buy or sell any security, fund units or services. Investment involves risks, including market, political, liquidity and currency risks. Past performance is not a guarantee or indicative of future results.

Date of first use: 24 July 2024

Doc ID: 3723491

For professional investors only