KEY TAKEAWAYS

-

The yield appeal: Bonds are a reliable source of income in times of economic uncertainty and market volatility. Compelling yields from a historical perspective make the asset class appealing to global investors.

-

Diversification* and flexibility: Monetary policy easing has started during the summer. With the Federal Reserve announcing its first rate cut in mid-September, the temporary divergences among central banks in developed markets (DM) are coming to an end. Investors should embrace a flexible and agile approach in order to adapt to a still uncertain macroeconomic backdrop.

-

Long-term opportunities: After the yield repricing in 2022 and 2023, bonds with a long-term horizon are also appealing. Emerging market (EM) debt offers an interesting risk-return profile and diversification* appeal for long-term allocations. Green bonds play an important role in long-term asset allocation offering investors the opportunity to diversify* their portfolios and align with green transition and net zero targets.

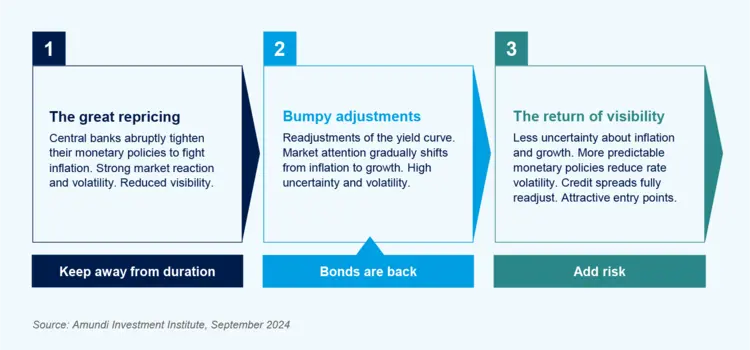

2024 has established a new market dynamic for bond investors. After the great repricing of 2022 and 2023 when market attention was mainly tilted towards inflation, 2024 is seeing a more balanced focus towards both inflation and growth.

Slowing inflation is positive for bonds and from a long term view, yields are still attractive. Investors may benefit from regional and curve opportunities driven by the different timing and speeds of central banks’ actions around the world and also from a positive outlook for EM bonds.

Fixed income investing is back as a core part of investors’ portfolios to deliver attractive risk-adjusted returns and seek portfolio stability at a time of high macroeconomic uncertainty.

Reason #1:

The yield appeal: Income is back

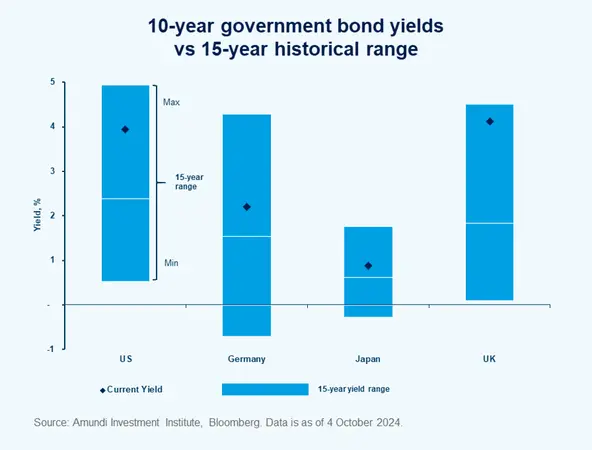

Bond markets offer appealing entry points in terms of yield from a historical perspective:

- yields for global-bond indices are at attractive levels, providing a carry buffer against interest rates’ movements;

- global investors could benefit from a diversified* range of opportunities across regions;

- with yields set to diminish, now is the time to look beyond short-term bonds.

Reason #2:

Diversification* and flexibility

After the great repricing, we are in the “Bonds are back” phase. This phase will still see high bond volatility driven by the market’s repricing of central banks’ actions, calling for a flexible approach to adapt to this ongoing high level of uncertainty.

Reason #3:

Long-term opportunities

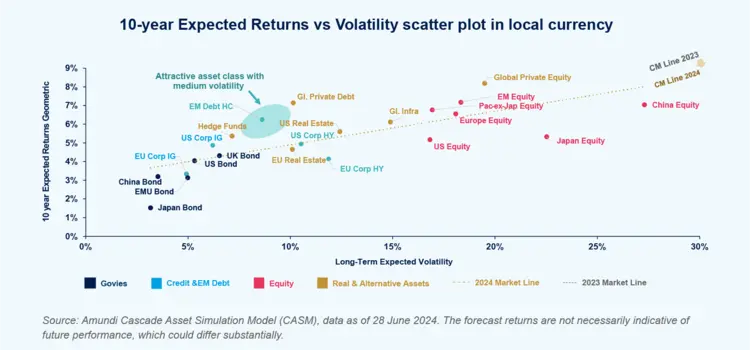

According to our Capital Markets Assumption, over a long-term horizon bonds are a key portfolio engine once again, particularly for a conservative global allocation:

- bond 10-year expected returns are back at compelling levels, particularly for govies and IG credit;

- in the search for diversification* opportunities, EM bonds show an attractive return profile with a commensurate risk profile, making them an appealing asset class for strategic asset allocation;

- green bonds offer investors not only diversification* potential, but also the opportunity to align their portfolios with green transition and net zero targets.

See our fixed income offer

Amundi Funds Global Aggregate Bond

Amundi Funds Global Corporate Bond

Amundi Funds Euro Corporate ESG Bond

Amundi Funds Emerging Markets Bond

Amundi Funds US Bond

* Diversification does not assure profit or protect against loss.

For Professional Clients Only

Unless otherwise stated, all information contained in this document is from Amundi Asset Management S.A.S. and is as of 15 October 2024. Diversification does not guarantee a profit or protect against a loss. The views expressed regarding market and economic trends are those of the author and not necessarily Amundi Asset Management S.A.S. and are subject to change at any time based on market and other conditions, and there can be no assurance that countries, markets or sectors will perform as expected. These views should not be relied upon as investment advice, a security recommendation, or as an indication of trading for any Amundi product. This material does not constitute an offer or solicitation to buy or sell any security, fund units or services. Investment involves risks, including market, political, liquidity and currency risks. Past performance is not a guarantee or indicative of future results.

Date of first use: 15 October 2024

Doc ID: 3847862