Investor Account Access

Investor access to Shareowner accounts and Closed End Funds accounts.

Pioneer Fund's portfolio managers integrate ESG analysis into their investment process by focusing on companies with sustainable business models and evaluating ESG-related risks. The Fund focuses on market leading companies with strong financial fundamentals that are trading below their intrinsic value.

ESG Strategy: Pioneer Fund pursues capital growth and reasonable income by investing in companies that we believe have sustainable business models.

|

|

|

|

Downside risk mitigation with strong upside captureFocusing on high-quality, sustainable, growing businesses has helped the Fund outperform in down markets and meaningfully participate in up markets equities at prices below intrinsic value coupled with a strict valuation and risk management we seek to limit downside risk. |

An Integrated, ESG-focused approach to evaluating the sustainability of a business*The Fund’s sustainability analysis includes ESG, financial and competitive factors, which results in a concentrated portfolio of 40 to 70 stocks |

Opportunistic allocation across growth and value stocksThe Portfolio’s core approach gives it the flexibility to migrate across the growth and value spectrum as we seek attractive investment opportunities, favoring companies benefitting from secular technology themes, such as 5G and artificial intelligence. |

*Effective July 1, 2018 these guidelines were formally incorporated into the Fund's prospectus

|

A Shift Towards Cyclicals in 2020 Has Benefited Pioneer Fund in 2021See how Pioneer Fund is positioned to pursue cyclical opportunities in 2021. |

|

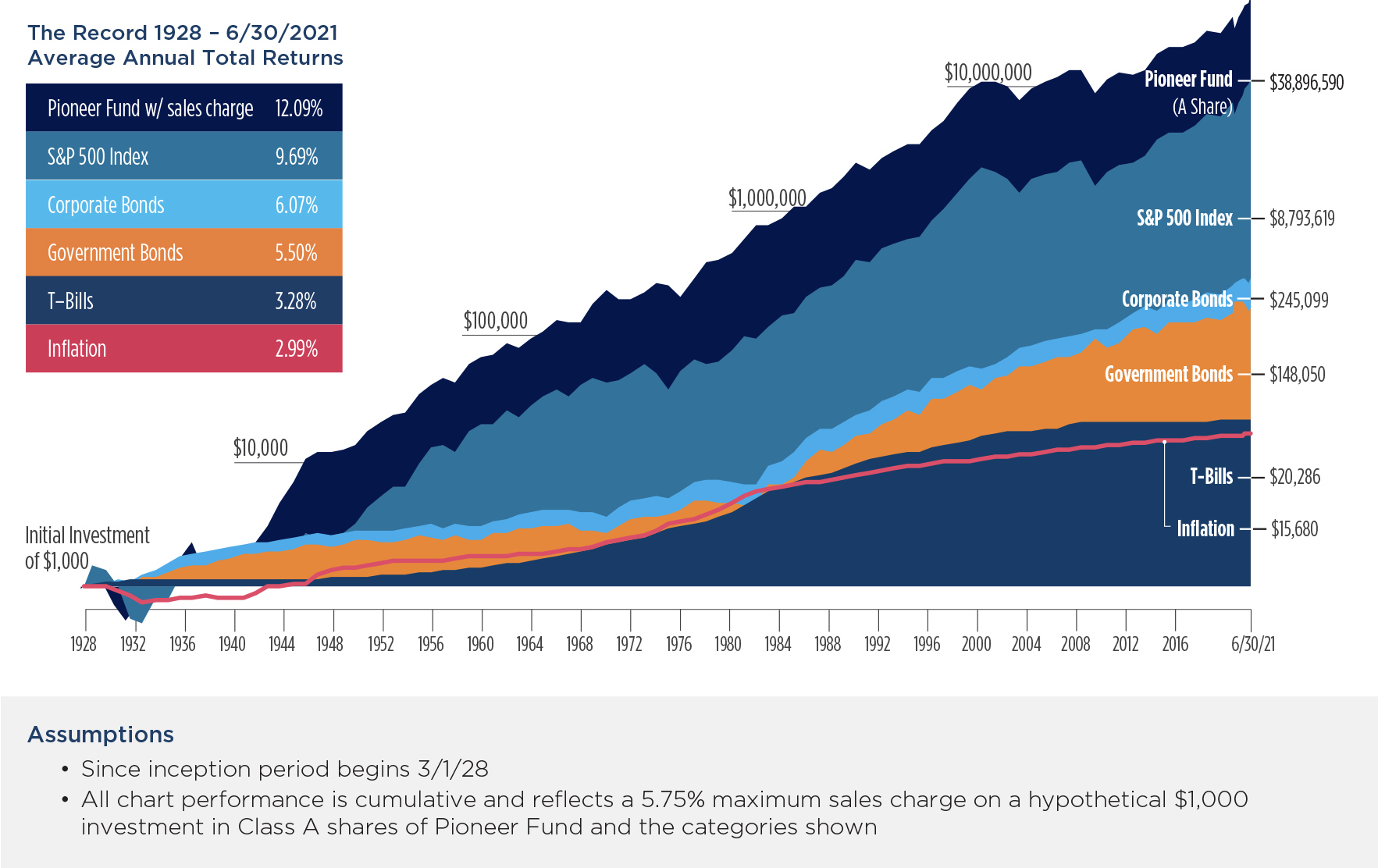

Pioneer Fund has helped investors pursue their goals for over 90 years —through wars, recessions and a long list of other market highs and lows. In addition, the Fund has outpaced the popular investments shown here, as well as inflation, since its inception. |

|

1-Year |

3-Year |

5-Year |

10-Year |

Since Inception |

||

|---|---|---|---|---|---|---|---|

| Pioneer Fund (Y Share) | 22.92% |

8.62% |

15.36% |

13.44% |

12.10% |

||

| A Share w/o sales charge | 22.58% |

8.31% |

15.01% |

13.13% |

12.00% |

||

| A Share w/sales charge | 15.53% |

6.19% |

13.66% |

12.46% |

11.94% |

||

| S&P 500® Index | 21.45% |

7.24% |

12.89% |

11.57% |

8.52% |

||

Gross Expense Ratio (A): 0.93% | (Y): 0.75%. Net Expense Ratio (A): 0.93% | (Y): 0.65%. The Net Expense Ratio reflects contractual expense limitations currently in effect through 5/1/2025 for Class Y Shares. There can be no assurance that Amundi US will extend the expense limitations beyond such time. Please see the prospectus and financial statements for more information.

Past performance is no guarantee of future results.

While equity investments have historically offered a higher rate of return, they may be more volatile and riskier than fixed income investments. Corporate bonds offer a fixed principal value and a fixed rate of return if held to maturity. Government bonds and Treasury securities are guaranteed as to the timely payment of interest and principal; corporate bonds are not.

Please note, these results are not usual and investors should not expect similar results. S&P 500 data shown combines a number of indices. The 90-stock Composite was calculated from 1926 through February 1957 when S&P introduced the S&P 500 stock average including 425 industrials, 25 rails and 50 utilities, weighting the index substantially in favor of the industrials. S&P did not calculate the 500-stock index prior to March 1957, but used the old 90-share index (as well as the old 50 industrials, 20 rails and 20 utilities indices) to extend the data back to 1928. Corporate bonds represented by the US Long-Term Corporate Bond Index until 3/31/22 and then switched to the ICE BofA 10+ Year US Corporate Bond Index because the former index has been discontinued, government bonds by the US Long-Term Government Bond Index; treasuries by the US 30-Day T-Bill Index and inflation by the Consumer Price Index, which is a general measure of inflation. Indices are unmanaged and their returns assume reinvestment of dividends and, unlike mutual fund returns, do not reflect any fees or expenses associated with a mutual fund. It is not possible to invest directly in an index. The chart was prepared by Amundi US and is hypothetical, for illustrative purposes only. It does not represent the results of an investor’s actual experience with the Fund.

Source: Morningstar, Amundi US. Pioneer Fund’s A shares did not have an initial sales charge at inception. The initial sales charge on the A shares has varied throughout the Fund’s history and has sometimes been higher than the current initial sales charge of 5.75%. Keep in mind, the since inception results for Pioneer Fund are not usual and investors should not expect similar results. The results cover a lengthy time period where the effects of holding the Fund shares for the entire period and compounding had a material impact on the Fund’s return. It is important to note that there are no shareholders remaining from the Fund’s inception in 1928.

Tickers, CUSIPs

Class A: PIODX, 723682100 |

Investment ObjectiveReasonable income and capital growth. |

BenchmarkS&P 500 Index* Inception Date2/13/1928 |

*The Fund’s performance benchmark is shown. Information on any additional benchmark for regulatory purposes can be found in the prospectus.

Overall Y Share Morningstar RatingTM(out of 1,275 funds in the Large Blend Category) |

Morningstar Sustainability RatingsTM(out of 1,429 funds in the Large Blend Category Based on 98.55% of AUM) |

Morningstar Proprietary Risk-Adjusted Ratings Performance as of 2/28/2025

Morningstar Sustainability Ratings as of 1/31/2025

For more information about Morningstar Star RatingsTM including methodology, visit our

Strength Across the Board

page.

For more information about Morningstar Sustainability RatingsTM, please visit our

Sustainability Ratings

page.

We are long-term investors in high-quality large-cap companies. We seek to invest in companies with attractive long-term growth and income potential at points in time when their stocks are temporarily out of favor, possibly profiting both from the market's subsequently recognizing their value and the companies' own ability to create shareholder value.

|

|

|

|

Jeff Kripke |

Craig Sterling |

James Yu, CFA |

A Word About Risk: Pioneer Fund

The market prices of securities may go up or down, sometimes rapidly or unpredictably, due to general market conditions, such as real or perceived adverse economic, political, or regulatory conditions, recessions, inflation, changes in interest or currency rates, lack of liquidity in the bond markets, the spread of infectious illness or other public health issues or adverse investor sentiment.The Fund generally excludes corporate issuers that do not meet or exceed minimum ESG standards. Excluding specific issuers limits the universe of investments available to the Fund, which may mean forgoing some investment opportunities available to funds without similar ESG standards.

Before investing, consider the product's investment objectives, risks, charges and expenses. Contact your financial professional or Amundi US for a prospectus or summary prospectus containing this information. Read it carefully. To obtain a free prospectus or summary prospectus and for information on any Pioneer fund, please download it from our literature section.

Securities offered through Amundi Distributor US, Inc.

60 State Street, Boston, MA 02109

Underwriter of Pioneer mutual funds, Member

SIPC.

Not FDIC insured | May lose value | No bank guarantee Amundi Asset Management US, Inc. Form CRS Amundi Distributor US, Inc. Form CRS