Summary

In June 2024, following a months-long project led by its Board of Directors and Investment Committee, and involving close collaboration with central banks and other official institutions across Latin America, the Latin American Reserve Fund (FLAR) announced its role as a seeding partner of a Global Corporate Highest Rated ESG ETF launched by Amundi ETF, the Amundi Global Corporate SRI 1-5Y Highest Rated UCITS ETF1.

This initiative aims to leverage FLAR's expertise in responsible investing to create an ETF that central banks and public institutions can utilise for responsible reserve management. This project concluded with a comprehensive RFP process, through which Amundi was selected as the ETF manager.

Introduction to FLAR

The Latin American Reserve Fund (FLAR) is a distinguished supranational organisation comprising nine central banks across Latin America. Committed to enhancing financial and economic stability in the region, FLAR provides balance of payments and liquidity loans to its member countries. Over the past 45 years, FLAR has established itself as a credible hub for connection and collaboration among central banks and official institutions, making it a natural partner for innovative investment solutions.

As a member of the Network for Greening the Financial System (NGFS), FLAR continuously seeks to align responsible investing principles with traditional reserves management guidelines – security, liquidity, and return objectives. Like many central banks, FLAR and its members are required to invest in highly liquid, high-quality, and low-risk securities.

Issuing ESG ETFs

Two critical elements are essential for an ETF issuer to successfully manage ESG ETFs:

1. Capabilities and Experience in Designing Customised ESG Indices

ESG indices have become increasingly complex in recent years due to the expansion of available datasets and portfolio construction methodologies.

Amundi ETF, the largest European ETF issuer2, has co-developed ESG and Climate index solutions for public institutions since 2014, when it co-created the first series of low-carbon equity indices for two public pension funds in Europe. Since then, our engineering and product teams have significantly enhanced their capabilities to develop custom index solutions that incorporate the latest ESG and climate datasets and methodologies.

2. Active Ownership Policy Aligned with ESG ETF Objectives

While the construction of the ESG index – how securities are selected and weighted – is crucial for an ESG ETF to fulfil its purpose, the active ownership policy of the ETF issuer must also be carefully scrutinised to ensure consistency between the responsible investment goals and the effective stewardship of the assets. Amundi’s active ownership policy consistently ranks among the most assertive globally and positively contributes to achieving sustainable investing objectives1.

Why a Global Corporate Short Term High-Quality ETF ?

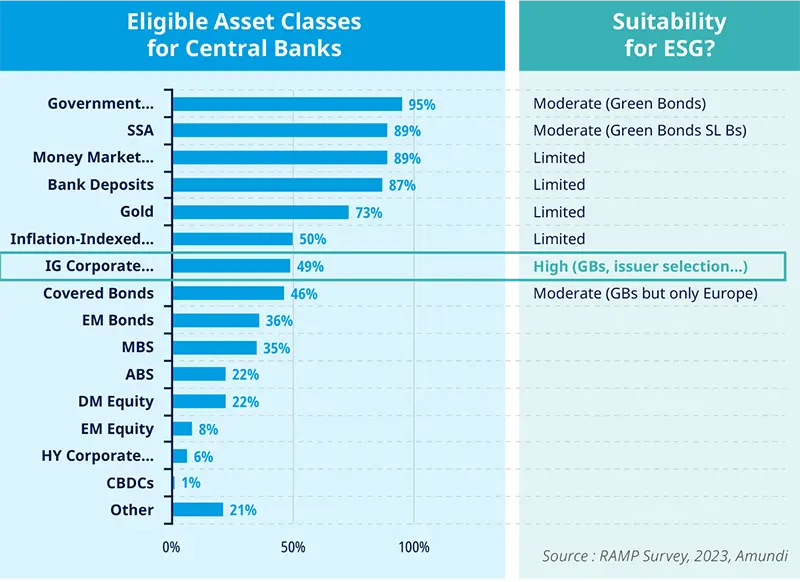

The 2023 Reserve Advisory and Management Partnership (RAMP) survey conducted by the World Bank indicates that high-quality investment-grade corporate bonds with short durations are highly eligible among central banks due to their low risk and high liquidity4. Furthermore, these bonds are well-suited for an ESG overlay, as ESG data is available for the vast majority of investment-grade corporate issuers.

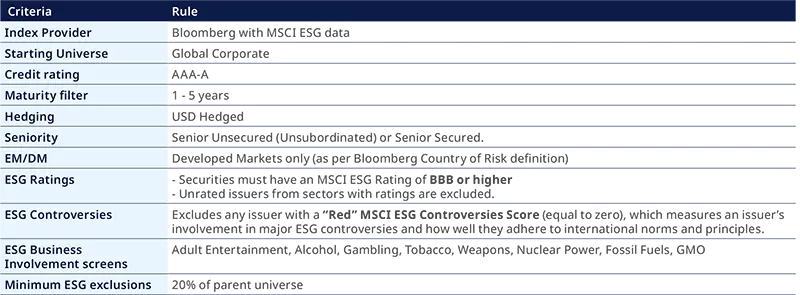

The high-level index design principles were based on a cap-weighted approach with implementation of selected exclusions. This approach was chosen over a more complex, optimisation-based approach, to ensure a high level of transparency.

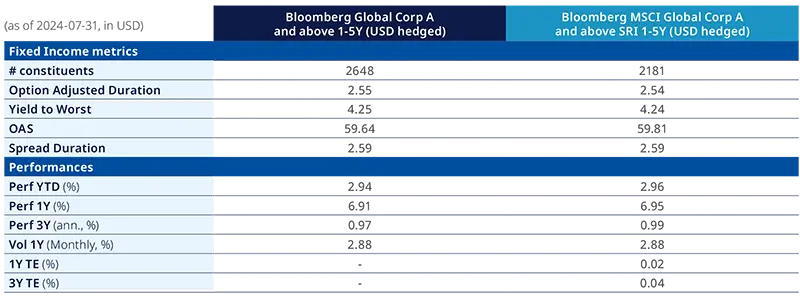

Despite the high level of ESG stringency in the proposed ESG approach, it is worth noting that the financial characteristics of the designed index align closely to that of the parent, non-ESG index, as illustrated in the table below:

For example, the ESG and non-ESG Global Corp A-AAA 1-5Y indices exhibit very similar duration, yield to worst, and option-adjusted spread, with a minimal tracking error of just 2 basis points over one year. This high level of similarity arises from the fact that the performance of high-quality, short-duration bonds is primarily driven by common factors such as currency or sector, rather than idiosyncratic risks like ESG scores. This makes this ETF exposure particularly attractive. Furthermore, the ESG index demonstrates better performance in terms of ESG metrics, such as average ESG rating and carbon footprint indicators, when compared to the non-ESG index.

Process and Timeline for Co-Designing ETFs

While each ETF co-design project has its own characteristics and objectives, the key milestones of such projects typically include:

In this step, the seed investor selects the ETF issuer responsible for structuring the new ETF. This process focuses on understanding the issuer's expertise in the asset class from both portfolio management and index design perspectives, as well as other relevant considerations such as distribution capabilities and active ownership policy.

The index methodology construction requires discussions among the ETF issuer, index provider, and seed investor. The goal is to identify and address the seed investor's investment guidelines and constraints, ensuring they can be translated into an investable, transparent index. Some constraints may be contradictory (e.g., low tracking error vs. high ESG score), necessitating careful arbitration between options.

Once the index methodology is finalised, the ETF launch process follows a standard procedure involving regulatory filing and approval, opening ETF accounts, seed investment, and ETF listing. Depending on the complexity of the initial requirements, a typical codesigned ETF can take between 6 and 12 months to launch.

The Amundi Global Corporate SRI 1-5Y Highest Rated UCITS ETF represents a significant advancement in the responsible investing landscape for central banks. By combining Amundi’s extensive expertise with FLAR’s strategic vision and the valuable insights and collaboration of other reserve managers, this initiative effectively addresses the immediate needs of central banks to manage their reserves responsibly, and demonstrates that this trend is relevant not only in the developed world but also in emerging markets. As central banks worldwide increasingly embrace ETFs as powerful tools for diversification and liquidity, Amundi remains committed to supporting their journey toward responsible investment solutions.

Read the Amundi ETF's interview of Iker Zubizarreta Abando

To find out more about our strategies

Sovereign Institutions

ETF, Indexing & Smart Beta

Sources

1. Index Bloomberg Ticker: H38487US

2. Source: Based on ETFGI data as at end July 2023, Amundi ETF is the leading European headquartered ETF provider within the European market.

3. https://shareaction.org/reports/voting-matters-2023

4. https://openknowledge.worldbank.org/server/api/core/bitstreams/c0c2d54b…