- Home

- Green bonds – providing a range of benefits beyond financial returns

Green bonds – providing a range of benefits beyond financial returns

May 2023 | 2 min read

Green bonds – providing a range of benefits beyond financial returns

In recent years, the interest in sustainable development has grown considerably, being seen as a solution that could sustain human needs without jeopardizing the natural environment. The economic growth that we have witnessed in the last century has been sustained by the use of fossil fuels, whose emissions have contributed to rising temperatures and increasing CO2 levels.

As climate change is the most pressing issue at a global level, companies, governments, civil society and investors should all play a role in finding appropriate solutions.

World leaders reached the Paris agreement in 20151, with a commitment to reduce global greenhouse gas emissions and limit the rise of global temperature to 1.5°C. In order to reach this goal, countries have to increase energy efficiency, reduce the use of fossil fuels while preferring low-carbon power.

Financial resources are therefore required to support a shift towards a low carbon economy, leading to the creation of green bonds, fixed income instruments meant to be used to fund specific projects. These instruments are defined by the Green Bond Principles (GBP), a set of voluntary process guidelines from the International Capital Market Association (ICMA)2.

Therefore, we believe that green bonds could offer a range of benefits that go beyond their financial returns:

1. By selecting green bonds, investors could contribute to the overall wellbeing of the planet. These debt instruments are used to fund projects with a positive environmental aspect, such as investments in renewable energy, sustainable infrastructures, or recycling efforts.

2. As per other fixed income instruments, they could also increase the overall diversification* hence improving the risk-adjusted returns of more traditional portfolios.

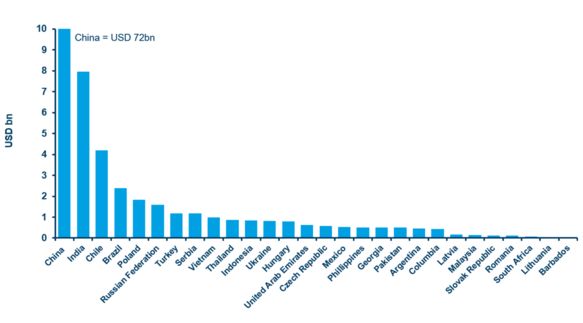

3. As the demand for sustainable investments is picking up, green bonds issuance is also on the rise3. This is evident in emerging markets, as with a total issuance of USD 122 bn (according to CBI data) in green bonds, 2021 was one of the strongest years for EMs4.

Emerging markets green bond issuances in 2021

Source: Amundi Institute on Climate Bonds Initiative data

Discover more about our Green Bonds funds offering

Amundi Funds Impact Green Bonds

The fund invests exclusively in global green bonds, fixed income securities that direct their proceeds to green projects with measurable and positive impact on the environment.

*Diversification does not guarantee profit or protect against loss.

Sources:

1 United Nations, The Paris Agreement, https://www.un.org/en/climatechange/paris-agreement

2Green Bonds are any type of bond instrument where the proceeds or an equivalent amount will be exclusively applied to finance or re-finance, in part or in full, new and/or existing eligible Green Projects and which are aligned with the four core components of the GBP. International Capital Markets Association, Green Bond Principles, Voluntary Process Guidelines for Issuing Green Bonds, June 2021.

3 S&P Global Market Intelligence, Global green bond issuance poised for rebound in 2023 amid policy push, 25 January 2023

4 Amundi Institute, Building bridges to India’s future investment opportunities, 15 May 2023

Important information

Unless otherwise stated, all information contained in this document is from Amundi Asset Management S.A.S. and is as of 31 May 2023. Diversification does not guarantee a profit or protect against a loss. The views expressed regarding market and economic trends are those of the author and not necessarily Amundi Asset Management S.A.S. and are subject to change at any time based on market and other conditions, and there can be no assurance that countries, markets or sectors will perform as expected. These views should not be relied upon as investment advice, a security recommendation, or as an indication of trading for any Amundi product. This material does not constitute an offer or solicitation to buy or sell any security, fund units or services. All investors should seek professional advice prior to any investment decision, in order to determine the risks associated with the investment and its suitability. Investment involves risks, including market, political, liquidity and currency risks. Past performance is not a guarantee or indicative of future results.

Date of first use: 31 May 2023

Doc ID: 2929808

Learn more about our Convictions

Powered by Amundi Institute